4/11/2023

Apr 11, 2023

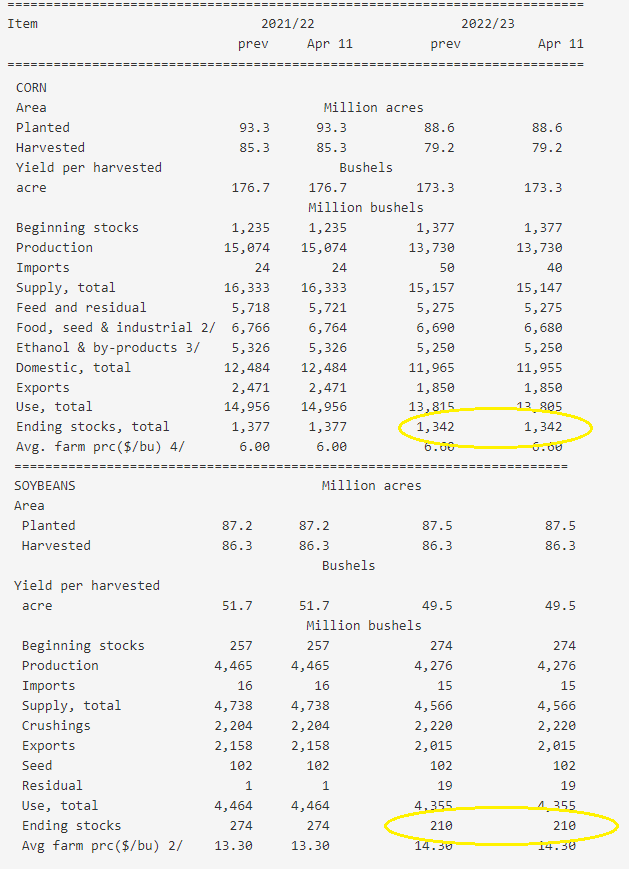

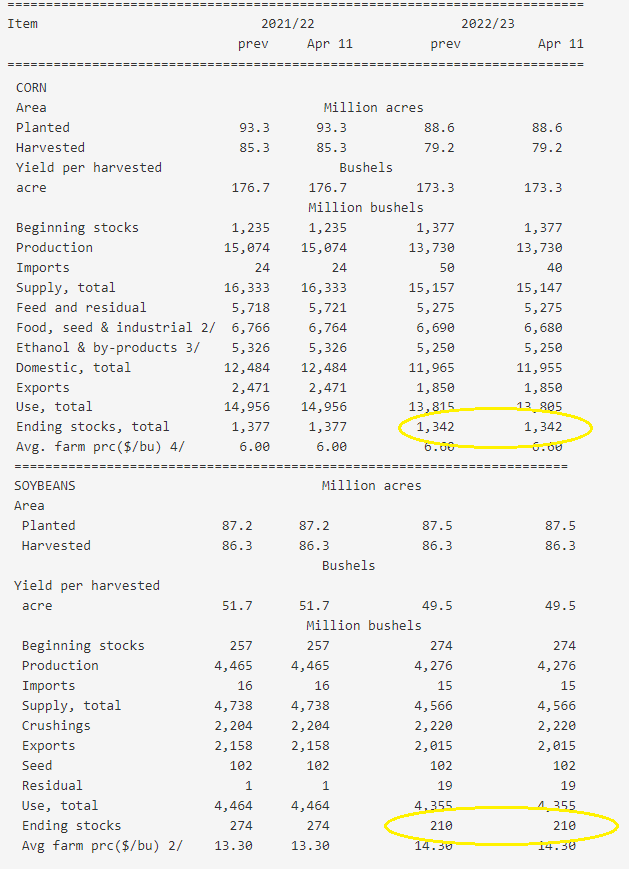

The USDA left the corn and soybean balance sheets unchanged in the April WASDE report. It was slightly bearish in a sense that trade had been expecting cuts to this year's ending stocks. Corn was trading unchanged prior to the report and the July contract was down as much as 7 cents as an immediate reaction at 11 a.m. Soybeans were trading around 10 cents higher before the report, were sold off to trade around 2 cents higher but managed to pick up some momentum late in the session and end the day with 4 to 10 cent gains. Our market will now be driven by weather and planting progress reports over the next month leading up to the May WASDE report. We still like the $6.50 cash price level on corn and we are still optimistic about potential $14.75-15.00 soybeans.