3/9/2022

Mar 10, 2022

The market already had premium priced in ahead of the WASDE report so an overall neutral/slightly bearish report triggered risk off. There was also some pressure from outside markets with crude oil putting up big reversals on the charts, trading over $20/barrel lower today, but did recover from lows. Crude oil and gas futures were still trading double digits in the red as of around 1 p.m. and trading near values similar to last week. The USDA confirmed two sales this morning, both for the 2021/22 marketing year: 100,000 tonnes of corn to Colombia and 20,000 tonnes of soybean oil to unknown.

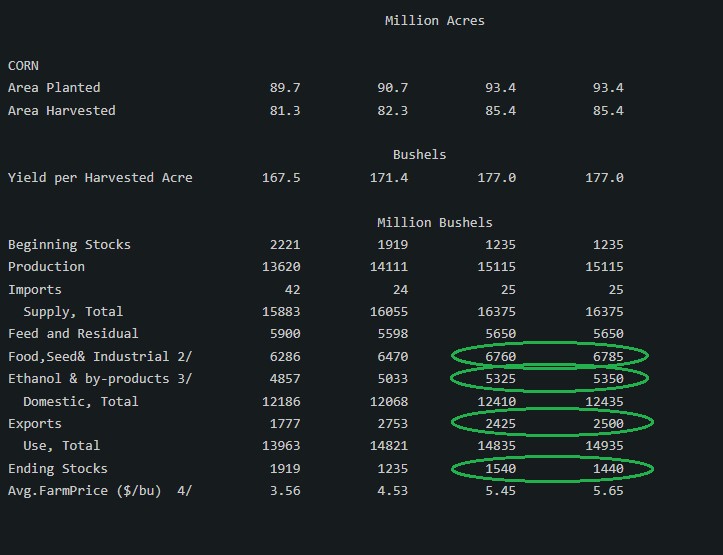

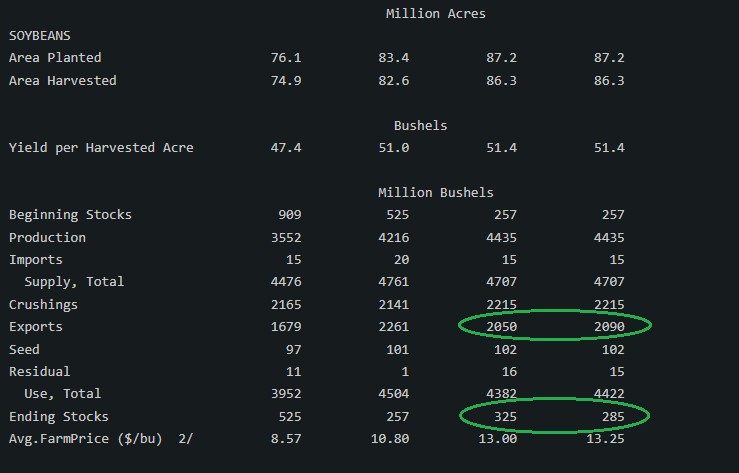

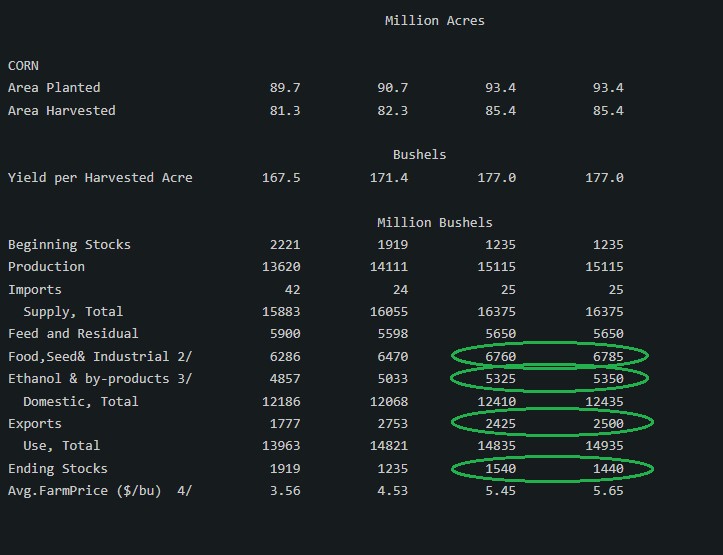

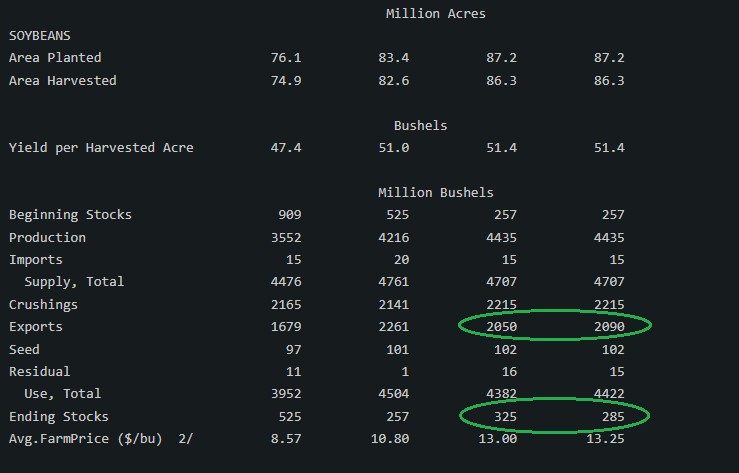

The cuts to US ending stocks were on target with what trade expected for corn and soybeans. South American crop estimates from the USDA were slightly under the average guesses. Wheat ending stocks came much higher than estimates predicted and an extremely overpriced wheat market responded accordingly.

The cuts to US ending stocks were on target with what trade expected for corn and soybeans. South American crop estimates from the USDA were slightly under the average guesses. Wheat ending stocks came much higher than estimates predicted and an extremely overpriced wheat market responded accordingly.