3/30/2022

Mar 30, 2022

Yesterday: Russia announced they would be withdrawing troops from Kyiv, war premium in grains eroded. Today: Russia announces there has been no breakthroughs in talks with Ukraine, grains jump in some spring-board type action. Daily highs were set early, only about a half of an hour into trade after the 8:30 market opening. The USDA kicked us off this morning with a soybean sale announcement of 128,000 tonnes for delivery to Mexico during the 2022/23 marketing year. Tomorrow at 11 a.m., the USDA will provide a large data dump that includes acres intentions for the 2022 U.S. crops and the quarterly grain stocks report. Weekly ethanol numbers showed production down 6,000 barrels/day to 1.04 mln bpd and stocks rising 381,000 barrels to 26.53 mln bbls. The market would most certainly be paying attention to all-time highs in ethanol stocks if we were able to exclude the first half 2020 (Covid) from our data. Production levels have been relatively normal and following seasonal trends but demand is not matching current production. A person has to wonder what the TRUE demand for energy is. Since overnight markets set spike highs 3 weeks ago, we have not even become close to within an arm's reach of touching them. Trade has ignored the past couple WASDE reports and went about business focused on Brazil weather and the Russia/Ukraine war. We already have estimates priced into our market but the USDA can always surprise us. It wouldn't hurt to have cash sell orders working around $7.25 for corn and $16.75+ on soybeans.

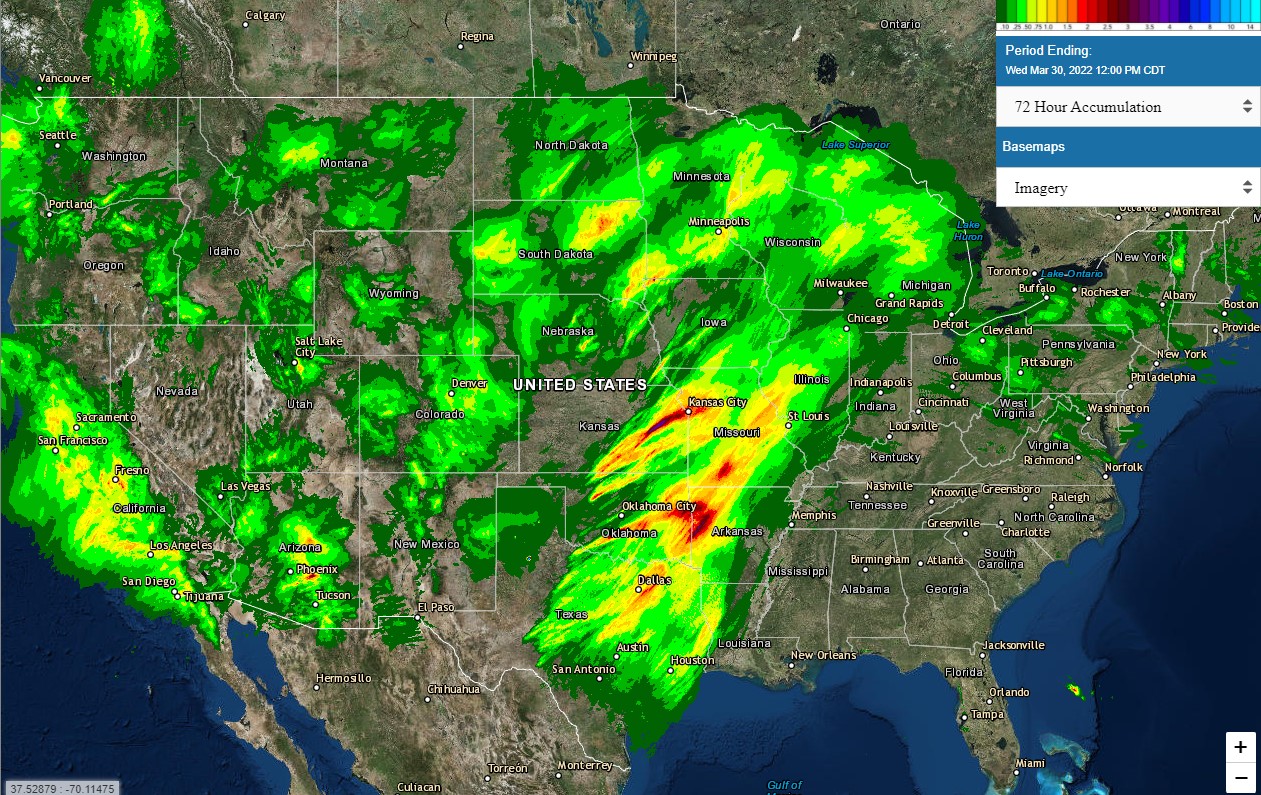

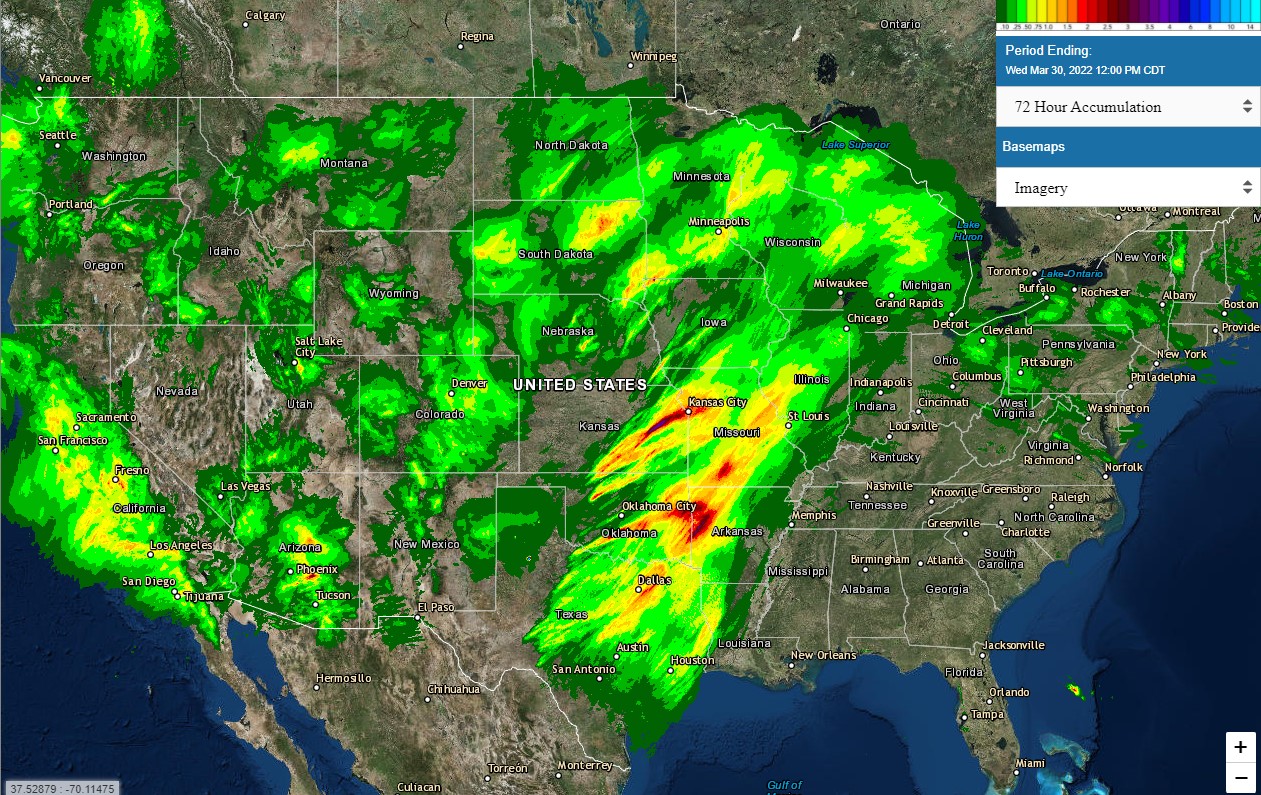

The market has not priced in any U.S. weather, yet. Precipitation is becoming more common across the grain belt as spring temperatures continue to migrate North.

The market has not priced in any U.S. weather, yet. Precipitation is becoming more common across the grain belt as spring temperatures continue to migrate North.