3/24/2022

Mar 24, 2022

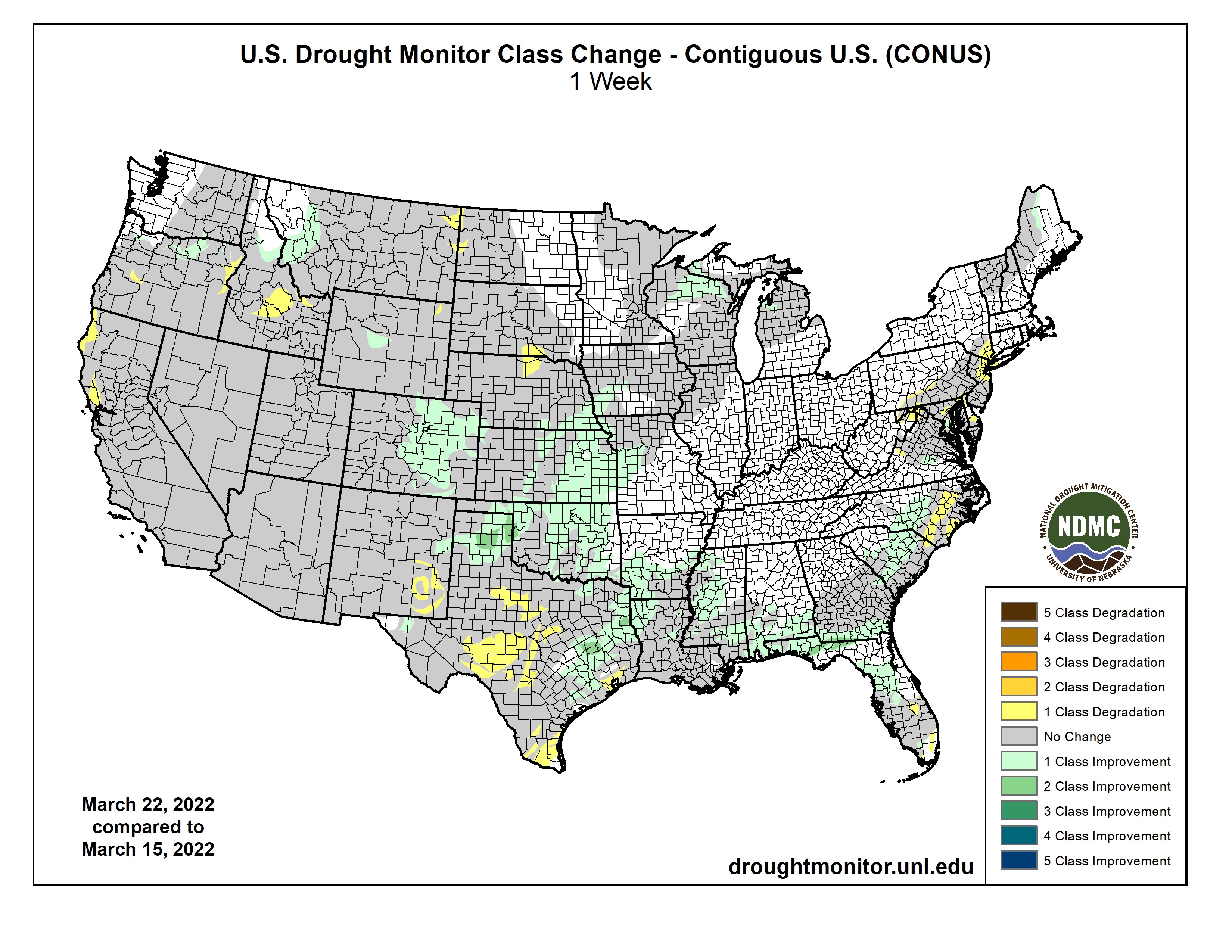

Higher at the start of overnight turned lower after the first couple hours of trade. No big changes fundamentally but the weekly export sales report came in with some lighter numbers and buoyed trade that was already down. Corn sales were on the low end of trade estimate with 979.5k tonnes sold and soybean sales underperformed with 412.2k tonnes sold versus at 500k tonne minimum trade guess. The USDA announced the sale of 318.2k tonnes of soybeans for delivery to unknown during the 2021/22 marketing year. We've had an impressive total volume of sales over the past 2 months but one has to begin to wonder where exporters are finding these soybeans. Wheat has been acting as an anchor, holding back the other grains so far this week with wheat areas receiving some moisture and forecasted for more at the right time as the winter wheat crop starts to come out of dormancy. We have been recycling the same headlines for quite some time now and its logical that we have just ran out of buyers at these price levels. One day after closing above 1700'0 for the first time, the May 2022 soybean contract flirted with a close back below that level, eking out a fractional finish above 1700’0. We hit some bench mark cash and 2022 new crop prices this week and faded off those today but new crop 2023 is still touching near $6 futures for corn and $13.50 futures for soybeans. Looks unimpressive next to today's cash values but considering no one knows where our market is heading, not terrible places to start.