3/17/2022

Mar 17, 2022

Corn and soybeans bounce back after spending a few days deep in the red. This should be viewed more as a technical bounce as we didn't have any big fundamental changes since yesterday. Simple money flow: overbought on the short term turned into oversold on the short term. Front months for corn and soybeans climb back above their 10-day moving averages which has been support for much of the past month. This morning, the USDA announced the sale of 136,000 tonnes of corn to unknown for the 2021/22 marketing year. With market movement bigger on the front end, new crop corn and soybeans remain reasonably within reach of their current contract highs. Weekly export sales were strong for old crop corn with 1.836 mln tonnes sold. Old crop beans put up a solid number with 1.253 mln tonnes sold. Totals for US corn and soybean export sales well exceed the pace needed to meet the USDA forecasts but logistically it will become difficult to get everything shipped within the marketing year. Trading volume has thinned out dramatically over the past week. With several traders sitting on the sidelines, it’s very possible for a few hands to push this market one direction or another. This is a prime environment for working sell orders in an attempt to catch price spikes. We have sell orders filling on a consistent basis throughout trading hours and if you would like to market your grain in this manner please contact your local Glacial Plains grain team representative.

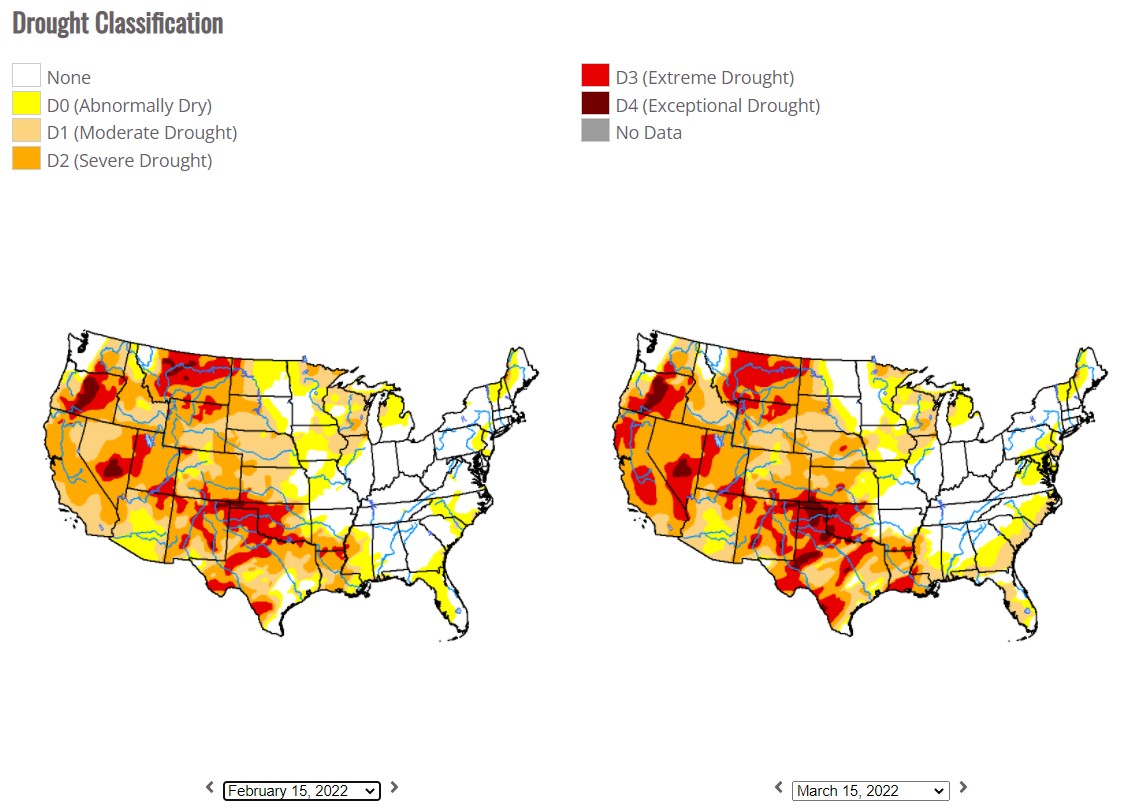

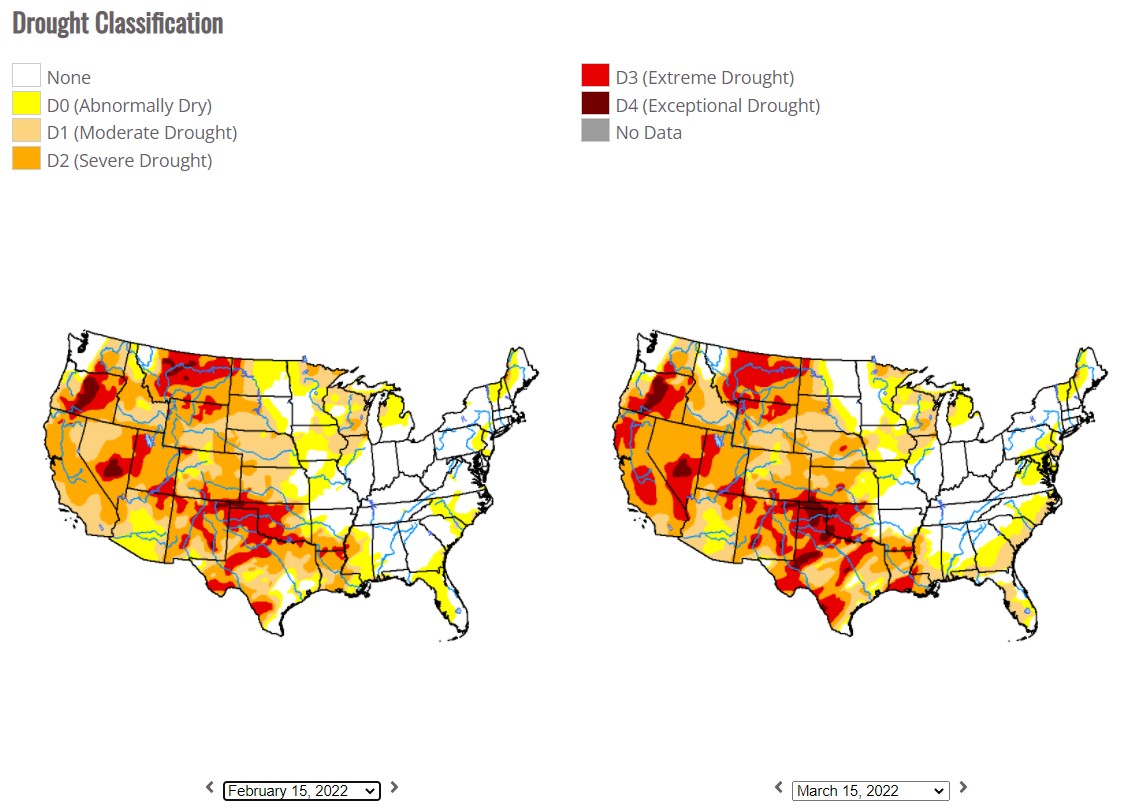

Map has degraded a fair amount since last week with more extreme/exceptional drought area in the Texas and Oklahoma panhandles. This was very supportive for wheat today.

Map has degraded a fair amount since last week with more extreme/exceptional drought area in the Texas and Oklahoma panhandles. This was very supportive for wheat today.