3/11/2022

Mar 11, 2022

The higher fuel market has increased the cost of freight dramatically, which is why you see the difference in the cash spread between our locations. Hopefully this fuel market comes back to reality soon. Unfortunately, we need to cover the increased cost. Today's price action was much more subtle to end the week. Grains traded mostly lower overnight but rallied back towards unchanged throughout the day with what appeared to be very disciplined buying, resulting in a modestly higher finish in corn. Corn traded 10-20 cent ranges and soybeans kept their highs and lows within about 30 cents of each other for the day. There was still plenty of movement inside those ranges but volatility was down and trade moved much slower compared to earlier in the week. The USDA kicked us off with a pair of sale announcements at 8 a.m. that included 128,900 tonnes of corn to unknown in 2021/22 and 264,000 tonnes of soybeans to China in 2022/23. Rail freight has become extremely expensive and fuel surcharges continue to increase, making existing and new sales tedious to navigate in the near future. Overall, basis continues to soften on the front end with processors and end users bidding defensively after a large movement of cash grain to begin the month. Enjoy what looks to be a great weekend.

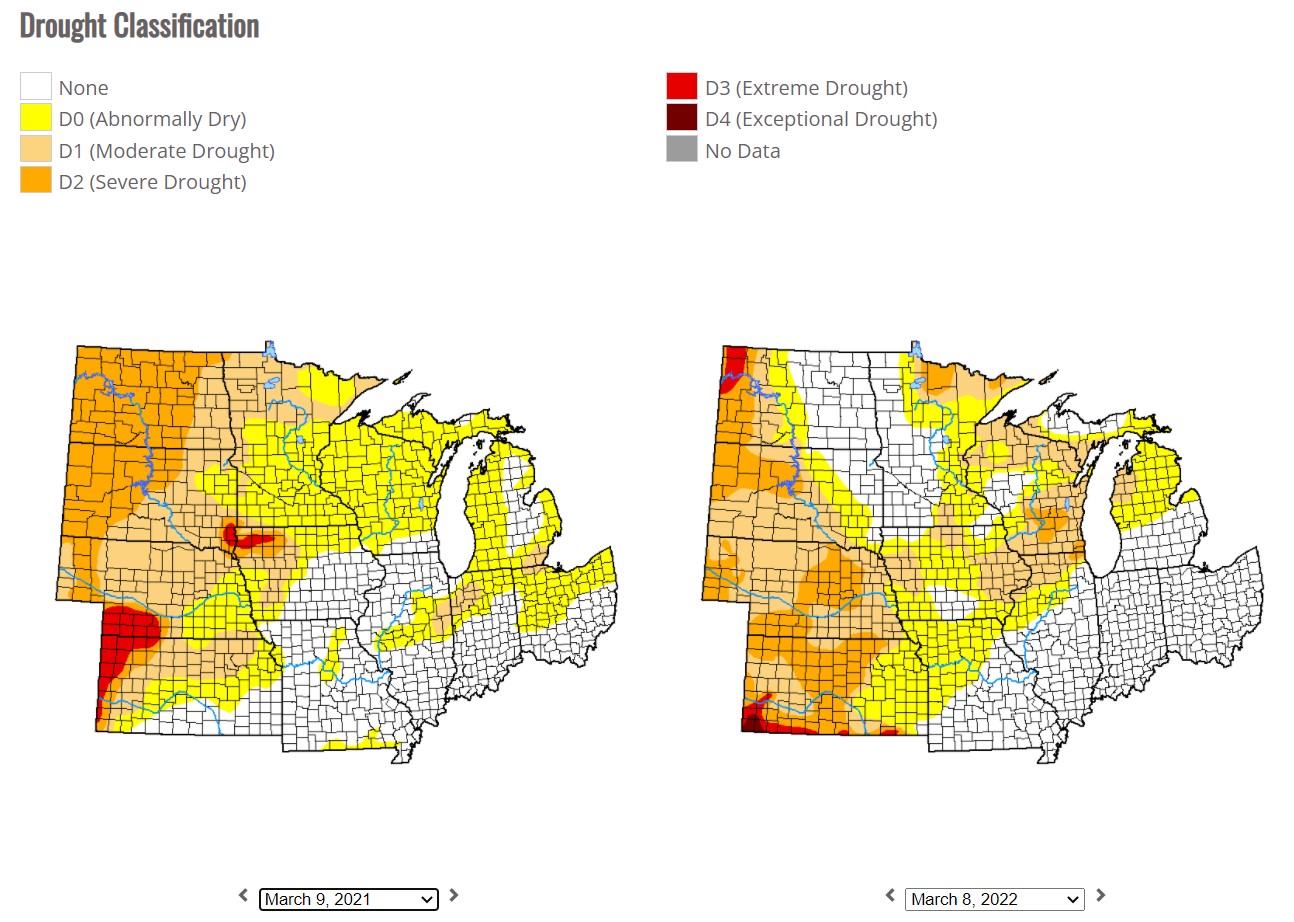

With spring finally arriving for us next week, US weather will continuously become more important.