2/8/2023

Feb 08, 2023

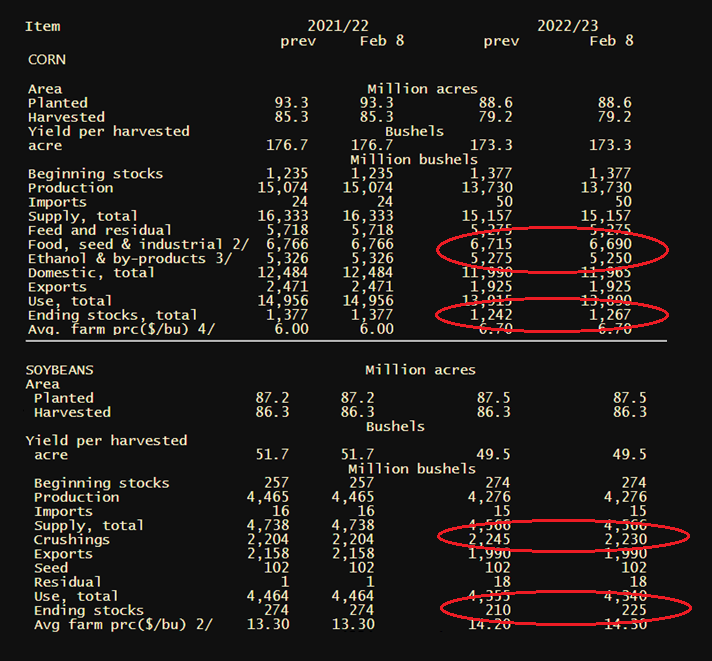

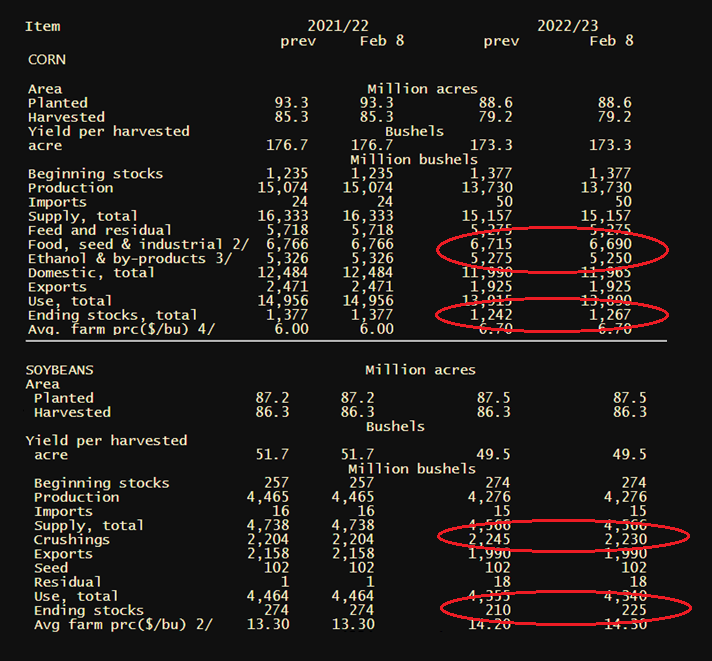

This month's WASDE update gave trade a slightly bearish surprise for corn and soybeans. The USDA lowered ethanol and feed/seed/residual use for corn and left exports unchanged. Leaving exports unchanged definitely opens the door for the USDA to make cuts on this line in future reports unless some large-scale buying comes in soon. The numbers trickle down to a small increase of 25 million bushels to our 2022/23 corn ending stocks. The biggest surprise in today's report was the 15-million-bushel increase to soybean ending stocks for the current crop year. The USDA lowered crush demand and left exports unchanged to take our soybean balance sheet to a net increase. Trade had expected an increase in soy exports.