2/8/2022

Feb 08, 2022

One day ahead of the February WASDE report sees some risk coming off in corn and soybeans, following some likely profit taking in soy oil and crude oil. Soybean meal traded a five-dollar range but finished modestly higher on the day. We filled the gap from Sunday night's higher open on the March 22 bean contract but all other gaps are still in place on the charts. The USDA announced two sales this morning at 8 a.m.; 132,000 tonnes of soybeans to China for the 2022/23 marketing year and 332,000 tonnes of soybeans to unknown for the 2022/23 marketing year. Wheat bounced firmly higher after StatsCanada released a number tighter than expected for the December 31 stocks. This was supportive more for Spring Wheat than others but worldwide wheat demand is essentially routine and one shouldn't read into today's move too far. The heavy consensus for tomorrow's report is the USDA trimming both the corn and soybean ending stocks. The main focus will be what the USDA prints for their South American production numbers, a surprise either way could send trade off deep in either direction. Trade will be looking for increased US exports in correlation with lower production in Brazil and Argentina. Soybeans have been very volatile the past two weeks and 10-15 cents moves within a session seem effortless. From a FOB value standpoint, US corn is currently the most expensive globally. US Gulf soybeans have a slight advantage to Argentina but are a hefty premium to Brazil

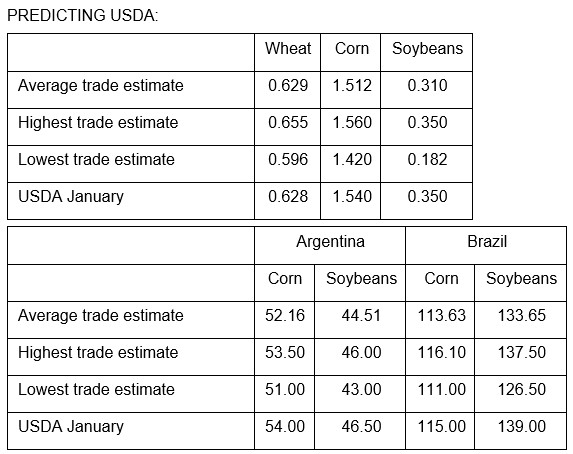

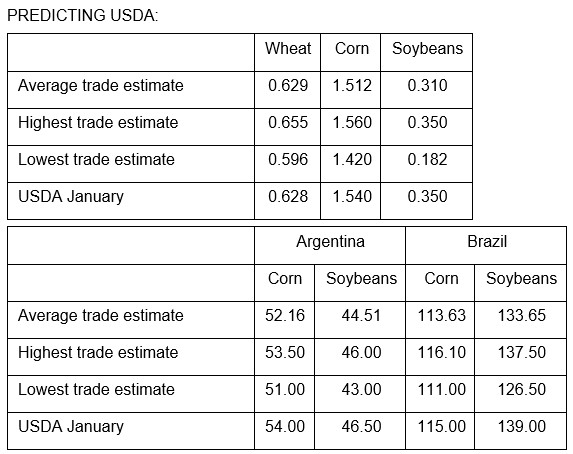

Trade estimates for tomorrow's report:

Trade estimates for tomorrow's report: