2/4/2022

Feb 04, 2022

Another back-and-forth day on the board with corn and soybeans both managing to finishing the week on a stronger tone after spending most of the day session in the red. In the short term, trade appears to be satisfied with soybean price levels, finding selling interest in the 1555'0-1560'0 area and buying interest in the 1530'-1535'0 range on the March 22 contract. We had an 8am sale announcement of 295,000 tonnes of soybeans for to delivery to unknown, split betwen the 2021/22 and 2022/23 marketing years, with a big majority delivered during the current market year. The volume of dollars changing hands just in soybeans this week has to be an eye-popping number. Corn had one of the more largely negative news weeks we have seen in the recent history and managed to just shrug it off. The ethanol report showing record high stocks and record low implied usage and the export market on the receiving end of a 15-million-bushel cancellation trimmed about 15 cents off of corn in the second half of the week but found some support on the 20-day moving average today. Starting Sunday night, trade will all be about positioning for the February WASDE report that will be released on Wednesday. Estimates show analysts are expecting small cuts to both the corn and soybeans carry outs. In my opinion, corn exports already needed a revision lower before the cancellation earlier this week. Weekly closes: cash corn down 16 cents, new crop corn up 4; cash beans 68 cents higher and new crop beans up 47 cents. Trade continues to push towards some long term, major resistance levels on the continuous charts.

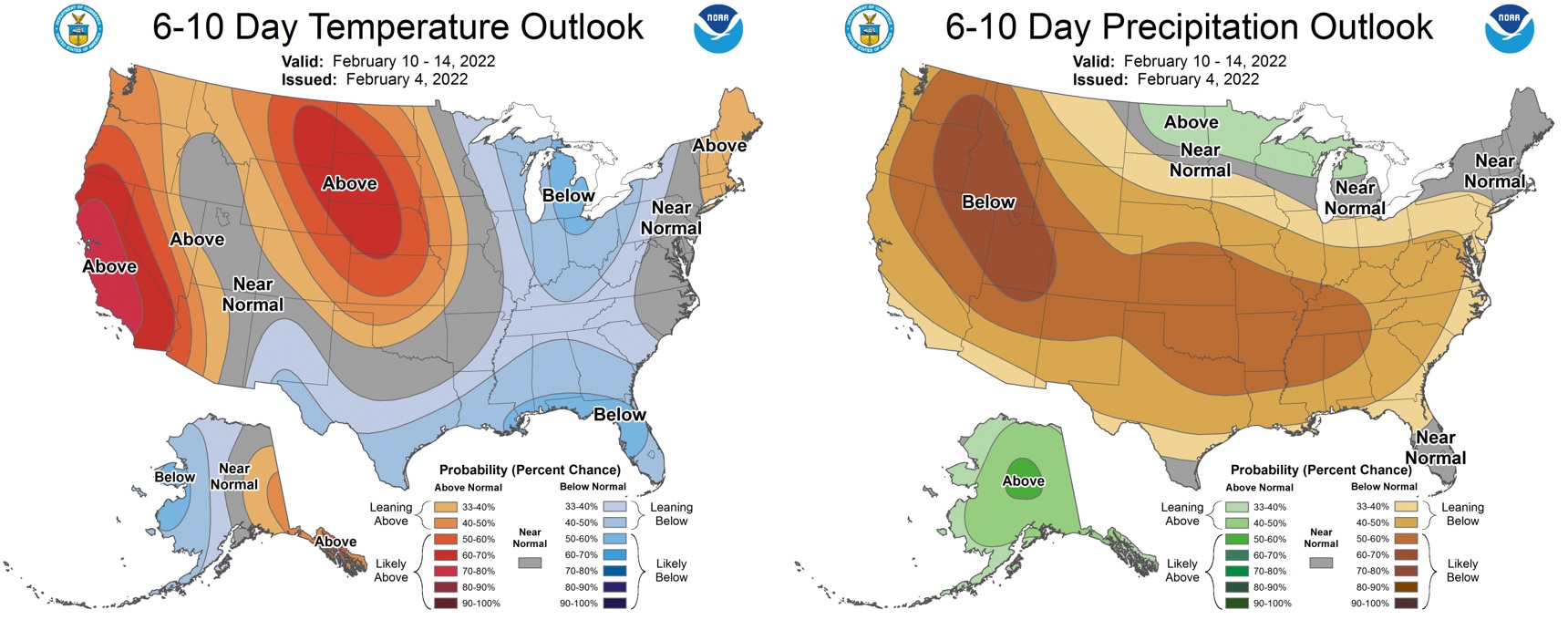

I am definitely ready for any temperature outlook that shows us "above normal!"

I am definitely ready for any temperature outlook that shows us "above normal!"