2/24/2023

Feb 24, 2023

Corn continued on its path lower during the Friday session, including the December 23 contract printing its lowest mark since mid-August. Soybeans attempted to sustain some higher trade throughout the session but the 7-10 cents lower trade in corn and wheat ranging between 17-25 cents down was too much. This week's price action has been mostly money driven with funds selling off length and spec money playing the short side. The faster we go down, the faster we find a bid, and this 30-cent price break in corn could be helpful in stirring up some fresh U.S. export demand. It's already rumored that China may be back in the market. The weekly sales report showed U.S. export sales were fairly vanilla last week. Corn and soybean sales totals were mid-range of their expectations with 823k tonnes of corn and 545k tonnes of soybeans sold last week. Corn export sales to date are short of the pace needed to meet the USDA target by 242 million bushels, unchanged from last week. Soybean export sales to date exceed their pace needed to meet the USDA target by 53 million bushels, down from 61 million last week.

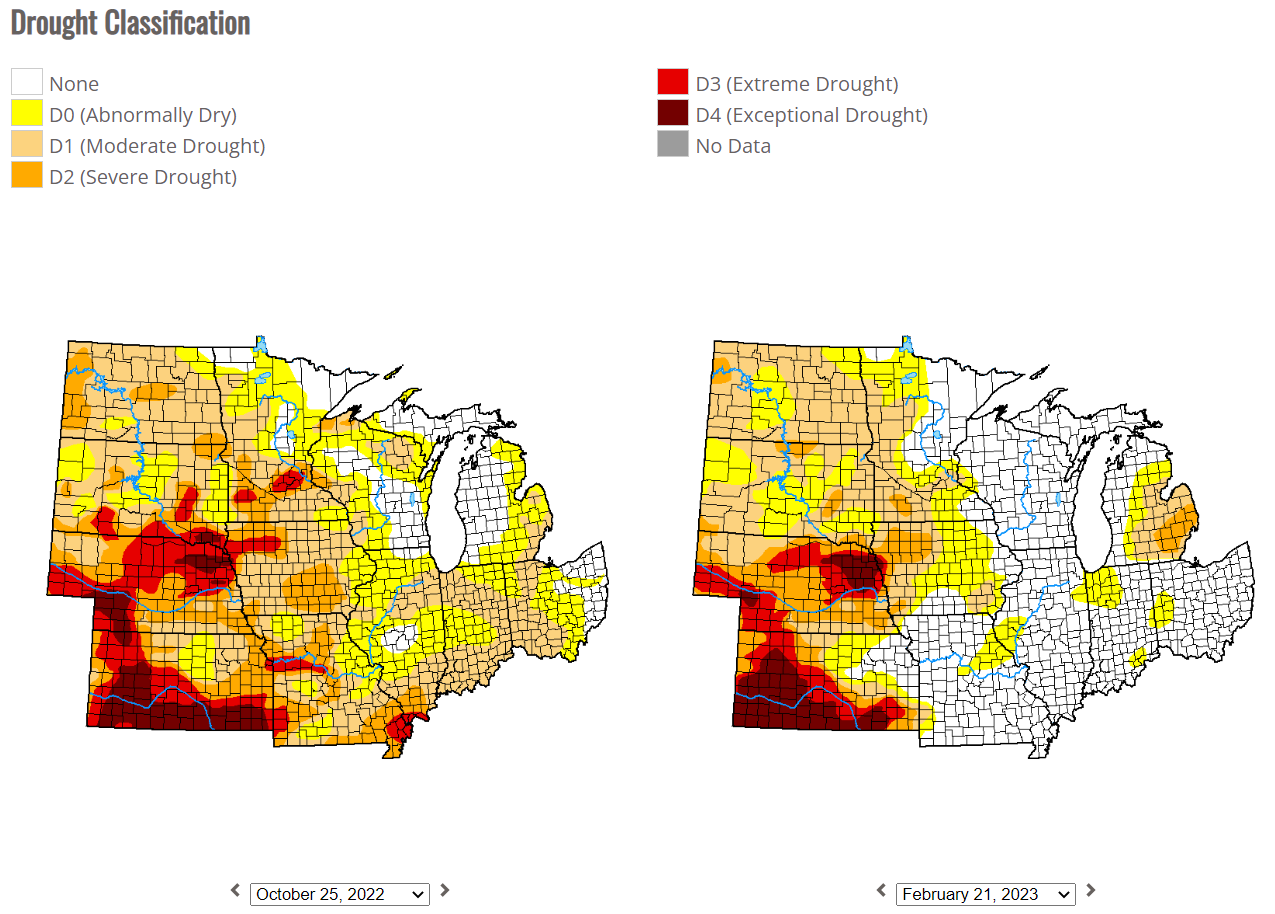

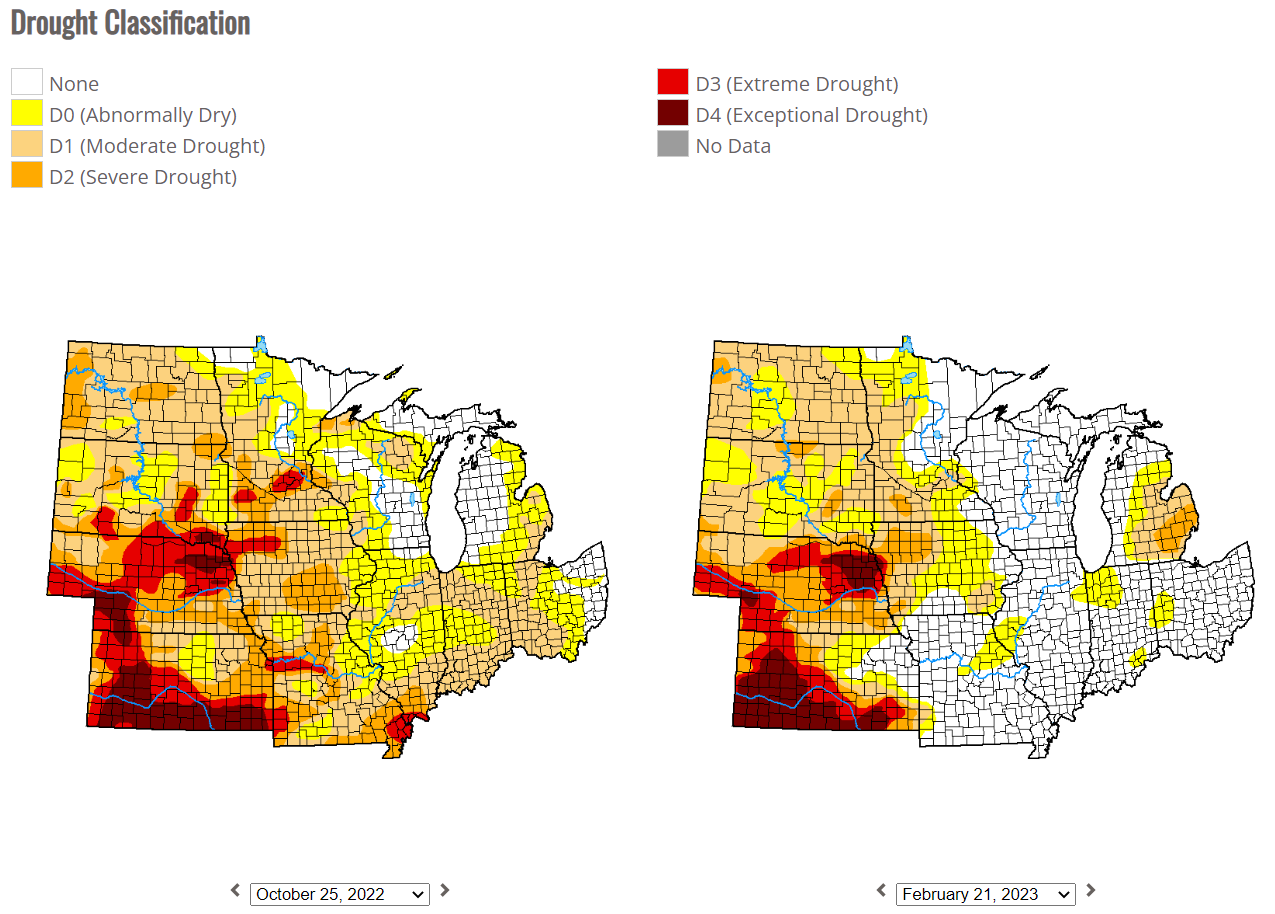

Some very good improvement in the drought monitor since harvest.

Some very good improvement in the drought monitor since harvest.