2/22/2022

Feb 22, 2022

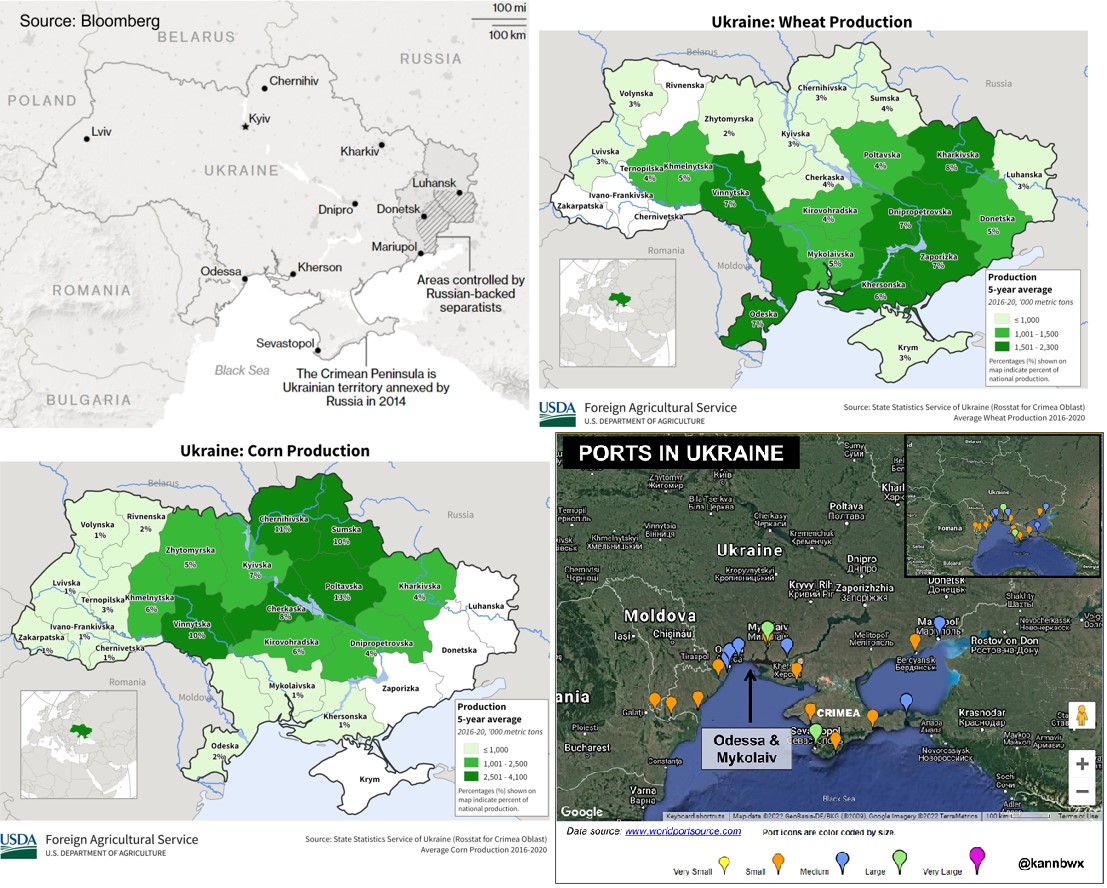

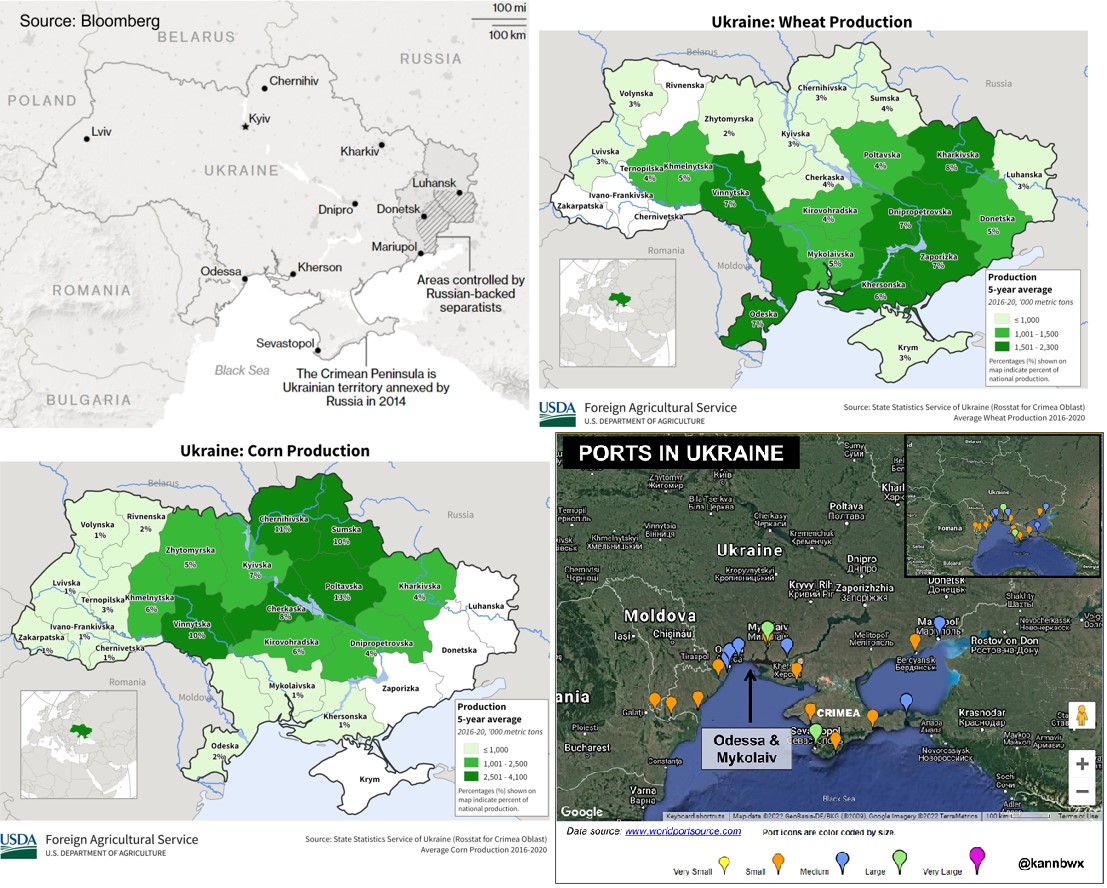

It was full risk-on in most commodities today following a weekend that featured ever-increasing tension between Ukraine and Russia. President Biden also announced new economic sanctions on Russia shortly before market close with the market setting new contract highs across a plethora of commodities in the final 15 minutes of trade. Trade is putting a huge risk premium on grains assuming that Ukrainian exports will be disrupted but the area in question is in far east region of the country and some distance away from major growing areas and the export facilities on the Black Sea coast. Lost in the chaos today were the weekly export inspections with corn inspections at 1.577 million tonnes and soybeans at 975k tonnes, both within range of trade expectations. There were also two export sales announced by the USDA at 8 a.m. this morning that included 120,000 tonnes of hard red winter wheat to Nigeria split evenly between the 2021/22 and 2022/23 marketing years and 132,000 tonnes of soybeans to China for the 2022/23 marketing year. Most common question asked: How high are soybeans going to go? Until crushers stop making money in soybean meal, oil, or both. With another big rally in the works over the past 4 days in soybeans, corn is now on the move to buy acres. Continue to scale up your sales as we ride this wave, taking bites of this market on the way up.