12/21/2022

Dec 21, 2022

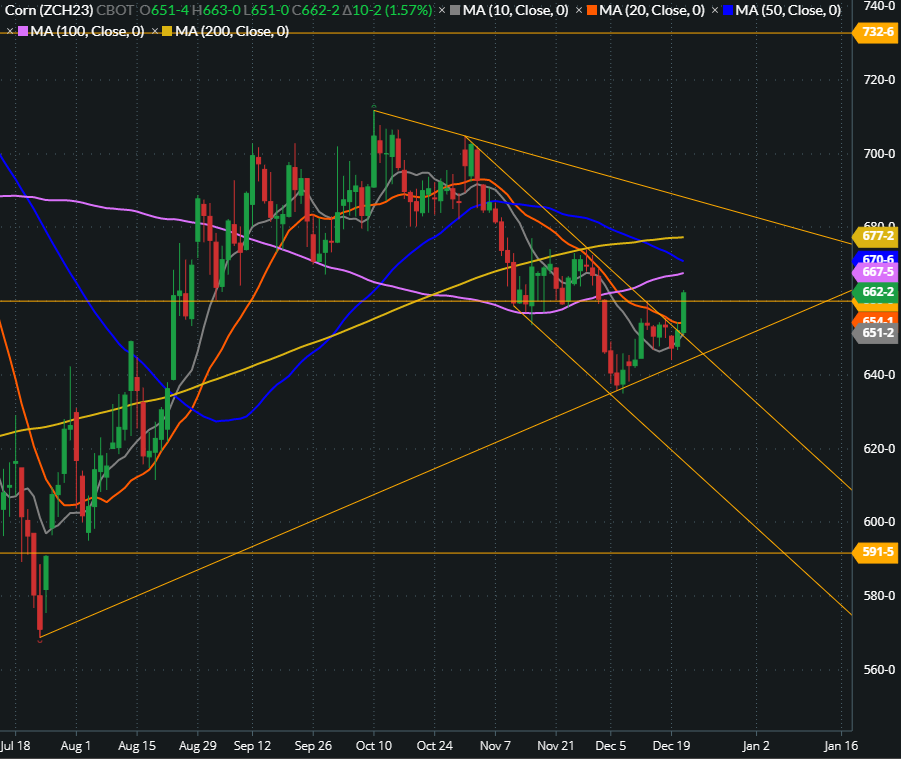

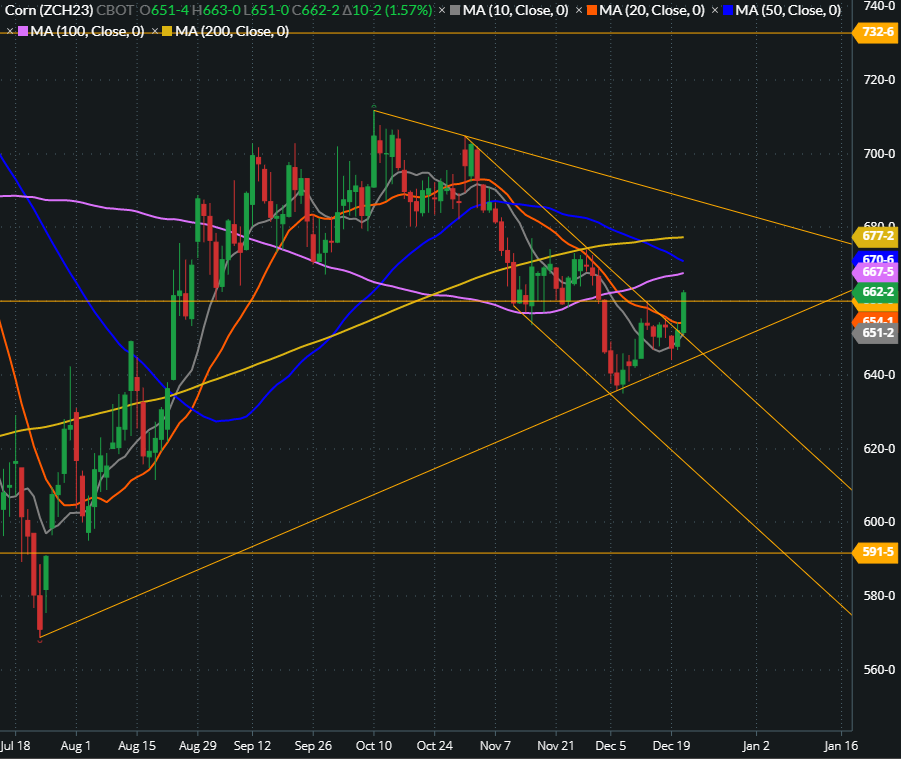

Corn ended Wednesday 2-10 cents higher in firm fashion with the March 2023 contract trading fresh 3-week highs. Soybeans traded either side of unchanged, closing 1-4 cents higher out to the November 2023 contract, supported mostly on rumors of some fresh China business. There were no export sale announcements this morning but today's rally in corn sparked some farmer selling. Weekly ethanol data showed output down 32,000 barrels per day to 1.03 mln bpd and stocks off 342,000 barrels to 24.07 mln bbls. Corn use for ethanol is very close to the pace needed to meet the USDA forecast for the 2022/23 marketing year. Corn basis is showing signs of cracking with rail business stagnant and poor ethanol margins. The markets will trade a full session on Friday and will remain closed until 8:30am next Tuesday, Dec 27. Glacial Plains will be closed December 26.

Corn broke out of it’s down trend channel to the high side today. Assuming follow-through buying comes in for the final 2 days of trade this week, we’re looking at a move back into the 670’s as a big possibility. The 200-day moving average, finishing the day at 677’2, would be a prime target on a quick rally.

Corn broke out of it’s down trend channel to the high side today. Assuming follow-through buying comes in for the final 2 days of trade this week, we’re looking at a move back into the 670’s as a big possibility. The 200-day moving average, finishing the day at 677’2, would be a prime target on a quick rally.