12/19/2022

Dec 19, 2022

Corn and soybeans opened and traded lower through the entire session to start two weeks of holiday trade. Volume is expected to be thin and any moves made could be exaggerated with less hands in the market. Even though we started the week with a firm move lower, it’s a good idea to have some "crazy" sell orders working over the next two weeks. The weekly export sales report came in with the second biggest week of net sales for U.S. soybeans so far in 2022/23 with 2.948 million tonnes. This was well above the 2.0 mln tonne high estimate. Corn came in just above estimates at 950k tonnes. Corn exports have some making up to do after we turn the calendar to 2023 but that is when the U.S. corn export program is typically strong. The past two marketing years have been outliers in terms of corn sale volumes on the books ahead of the shipping season. Get ready for some extreme cold at the end of this week in our area. The markets will trade a full session on Friday and will remain closed until 8:30am next Tuesday, Dec 27. Glacial Plains will be closed December 26.

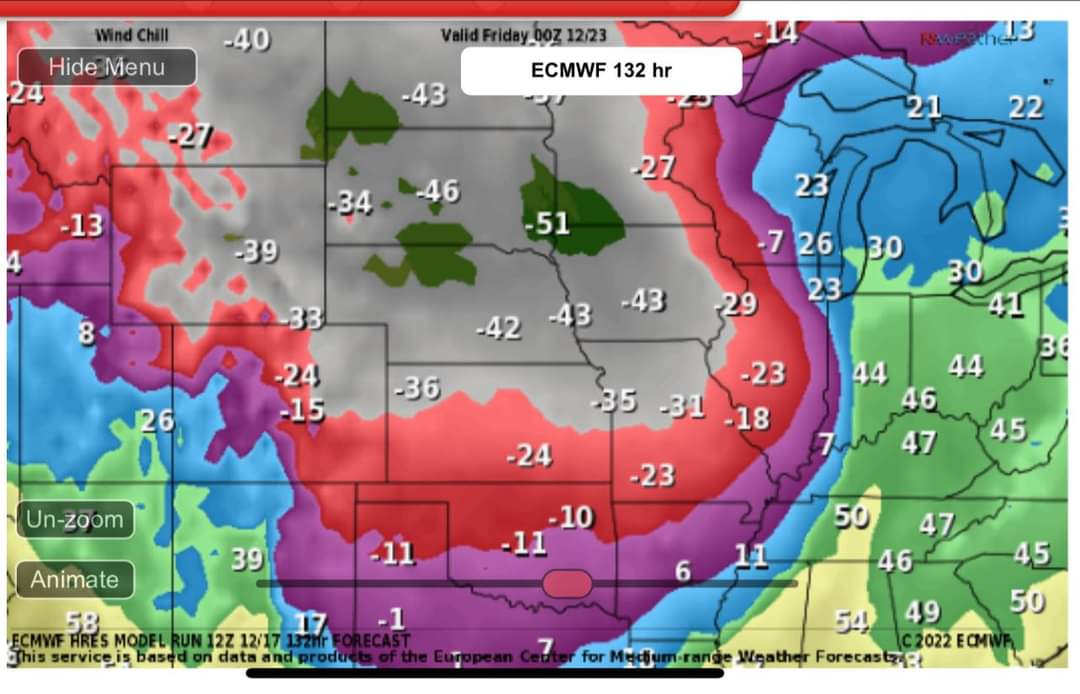

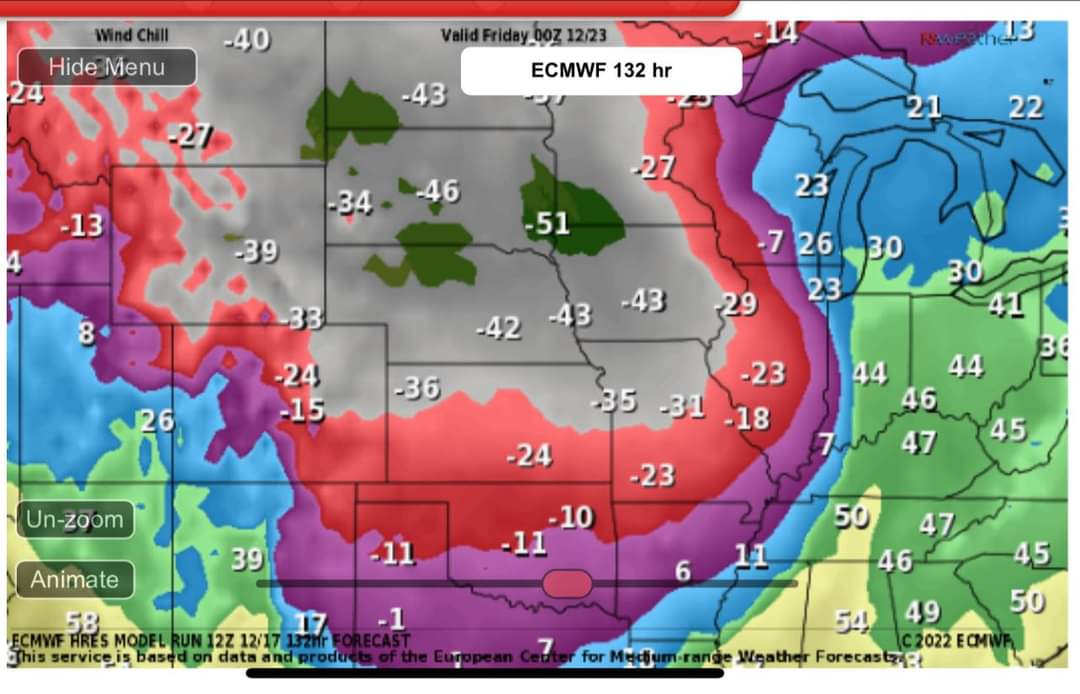

Wind chill forecasts for Thursday night.

Wind chill forecasts for Thursday night.