12/14/2021

Dec 14, 2021

Corn and soybeans come back strong off of their overnight lows for a textbook "turnaround Tuesday." Today's bounce back puts us basically unchanged on the week after 2 days of trade. Fundamentally, there hasn’t been any changes or news. The USDA 8 a.m. sales announcements have gone quiet after putting together a good run for the first half of December. China is hosting the winter Olympics in two months and it may be a while until we see them purchase to ramp up any type of imports. Portions of Chinese industry are cut back/shut down (ex: bean processors), need the country to look good on T.V. Overall, there is not much of an explanation for the price action we've seen this week. Figures for the November NOPA crush will be released tomorrow, with trade estimates ranging from 178-184 million bushels crushed for an average of 181.64 million. This will at least give us some sort of information for trade to chew on.

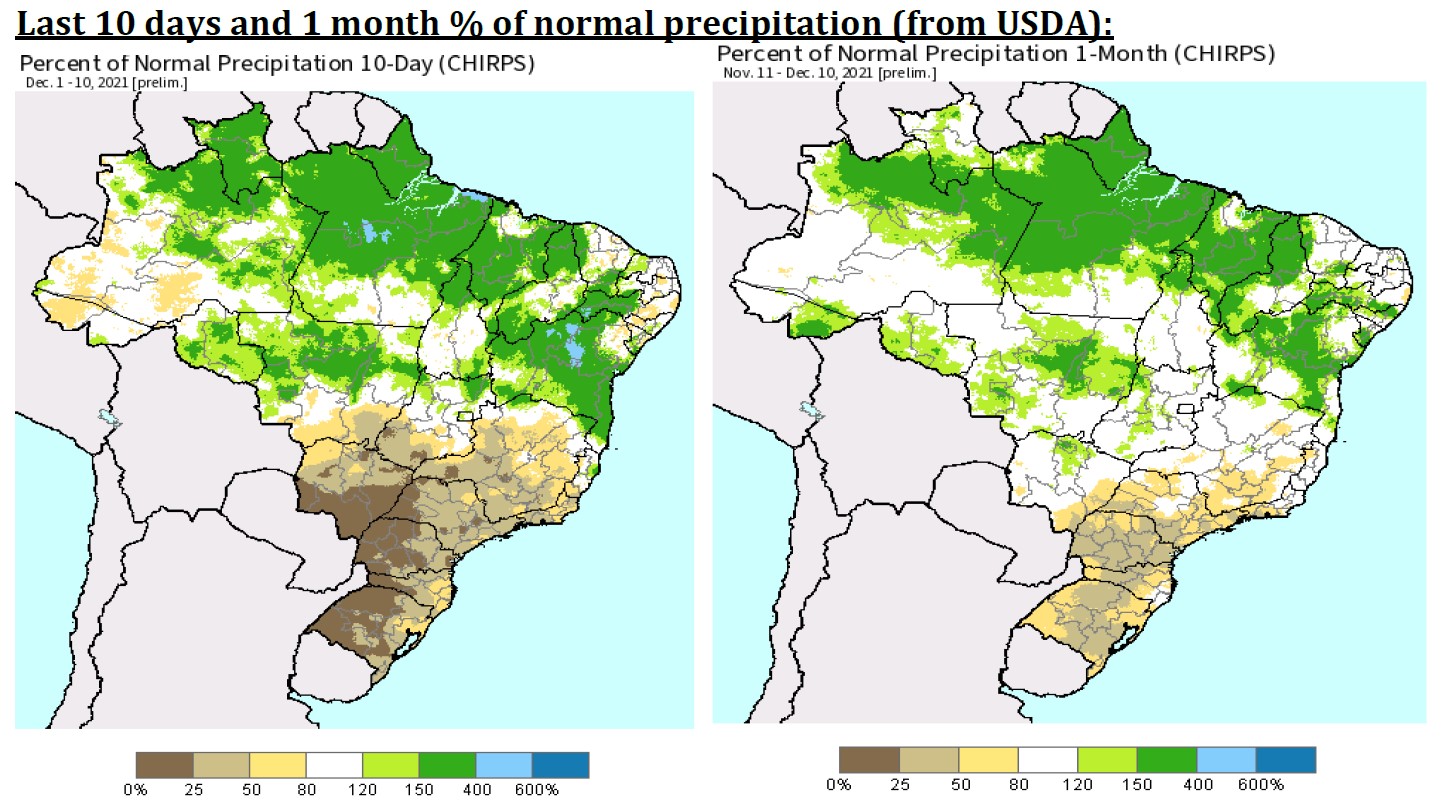

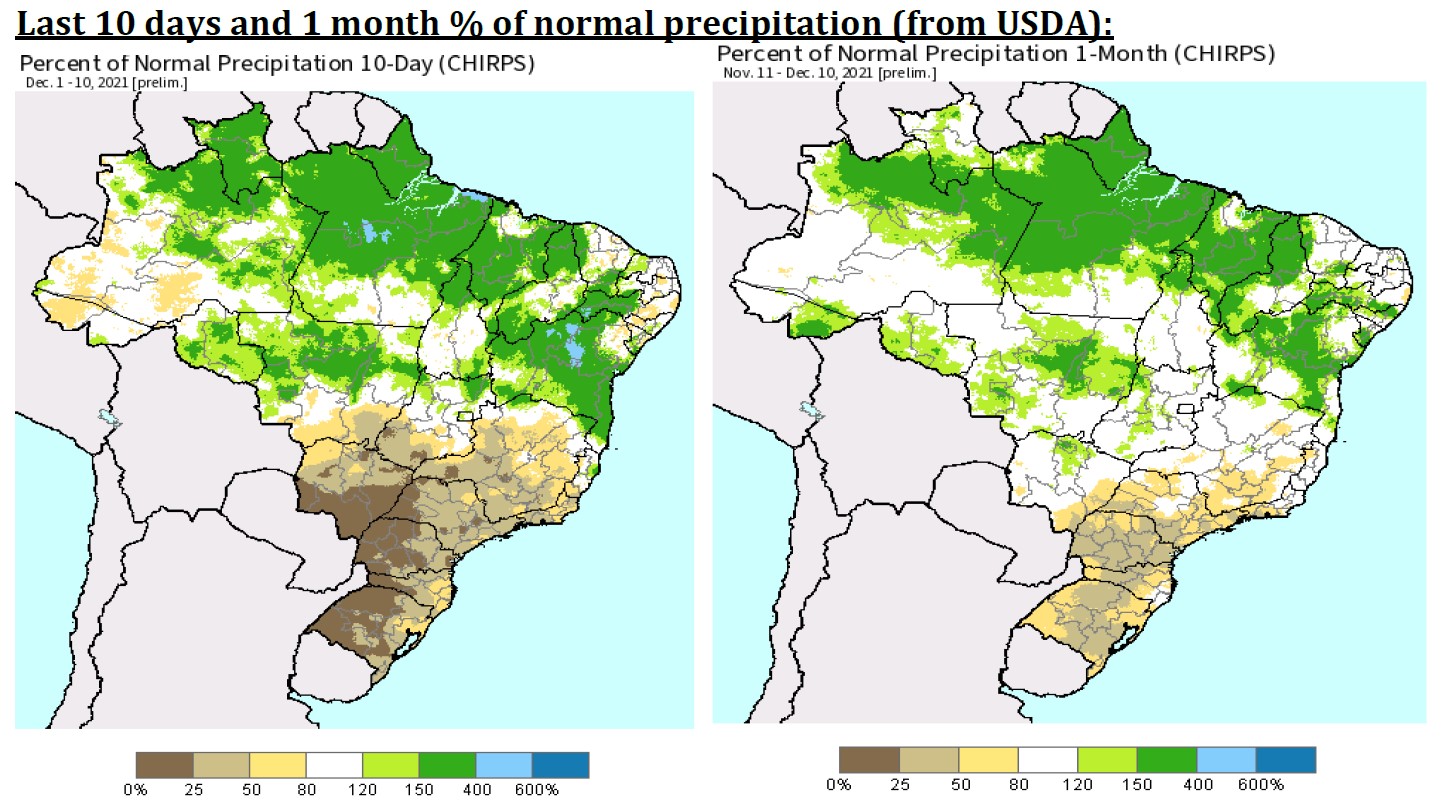

Trade is trying to create excitement out of some short-term dryness in Brazil, likely from a lack of any other news.

Trade is trying to create excitement out of some short-term dryness in Brazil, likely from a lack of any other news.