11/9/2021

Nov 09, 2021

Corn and soybeans received a shot of life with the WASDE report after trading very weak leading up to 11 a.m. Corn swung from trading 4 lower prior to the report to finish 3 higher on the day and soybeans from 7 lower to 23 higher at the close, but all well off of their report reaction highs. Just looking at the closing numbers, one would assume to report was very friendly for beans but we were just on the back end of four consecutive days of big lower moves in the commodity. FSA's November acres report was due today at noon but the report was postponed until 9am tomorrow, giving us the possibility of another day with some wild volatility. I am still strongly inclined to believe there is an additional one million acres of corn that the USDA is not including in this year's corn production. Assuming 90% of those acres are harvested at the national average of 177 bu/ac, this would increase the corn carryout by approximately 160 million bushels to 1.650 billion bushels.

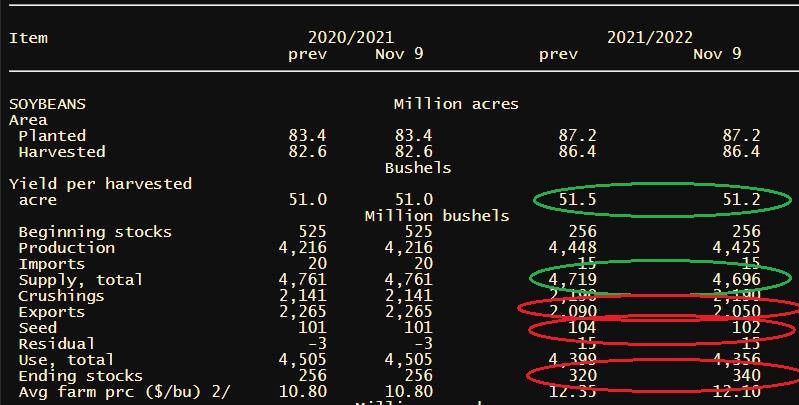

WASDE summary:

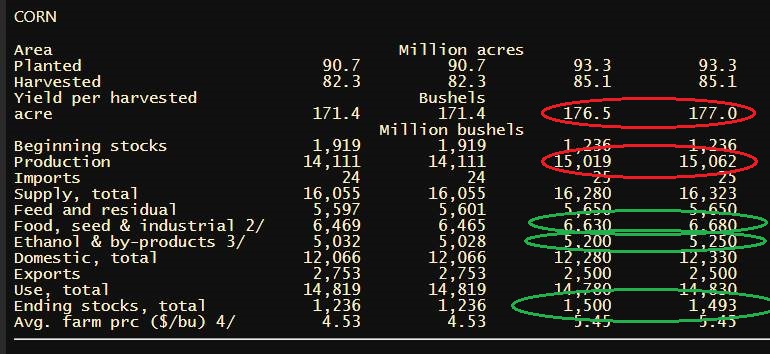

Corn yield increased to 177.0 (record), ethanol usage increased by 50 million bushels, netted a small 7 million bushel cut to our ending stocks. Very skeptical about corn exports remaining unchanged, likely should be cutback.

Soybean yield decreased 51.2 after trade estimated the USDA would be using a record tying yield of 51.9. This production decreased was offset with decreased exports and seed use, netting a 20 million bushel increase to our carryout. The average trade estimate for soybean ending stocks in this report was 362 million bushels. Beans finish 20+ cents higher today simply because the report wasn't as bearish as trade was expecting.

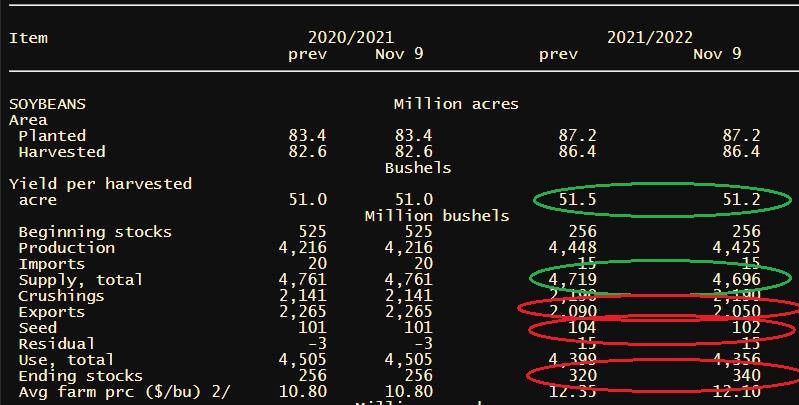

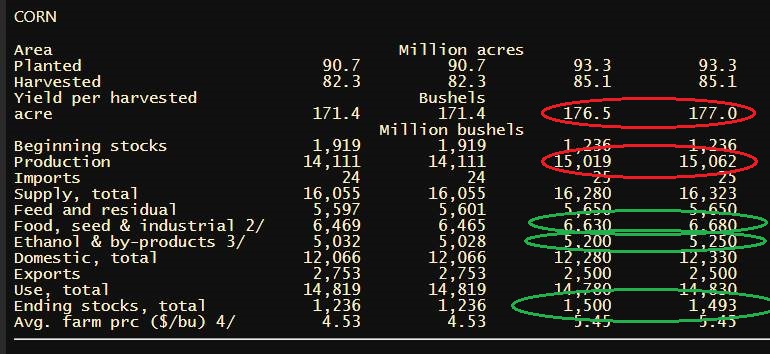

WASDE summary:

Corn yield increased to 177.0 (record), ethanol usage increased by 50 million bushels, netted a small 7 million bushel cut to our ending stocks. Very skeptical about corn exports remaining unchanged, likely should be cutback.

Soybean yield decreased 51.2 after trade estimated the USDA would be using a record tying yield of 51.9. This production decreased was offset with decreased exports and seed use, netting a 20 million bushel increase to our carryout. The average trade estimate for soybean ending stocks in this report was 362 million bushels. Beans finish 20+ cents higher today simply because the report wasn't as bearish as trade was expecting.