11/8/2021

Nov 08, 2021

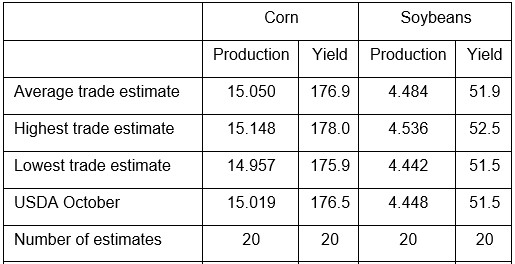

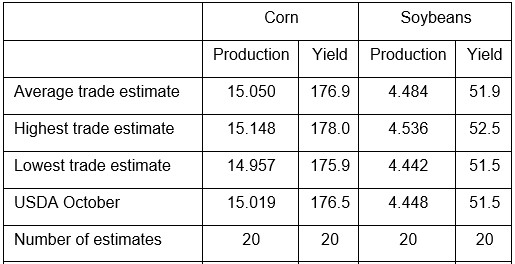

Another day of sell-off with oats leading the way down and their front month finishing 25 lower. Corn traded an unusually small range of 3 cents today, closing the day down 1-2 cents. We did get an 8am sale announcement of 150,000 tonnes of corn to Colombia for the 2021/22 marketing year. Soybeans lost 17 cents for the second consecutive day after some early production estimates released this morning showed the 21/22 Brazilian soy crop increasing by almost 2% from last month. The January soybean contract has lost a combined 68 cents in the last 4 trading days. Weekly export inspections were strong for soybeans and exceeded trade estimates, coming in at 2.647 million tonnes. Corn was on the low end of expectations at 563k tonnes and wheat was mid-range with 232k tonnes. Corn has retraced 50% of the rally it put in during the second half of October, settling mid-range one day ahead of the November WASDE. With never knowing what surprises could be in these reports, tomorrow could see some trade in the green and put together a nice turnaround-Tuesday. Currently, soybeans and corn appear relatively inexpensive on the board. It is widely anticipated we will see production increases for both US corn and soybeans for the 2021 crop, including a record corn yield number, the key will be if the USDA makes any demand changes to keep carryout increases minimal or a wash.

November WASDE yield estimates.

January soybeans did not stop to test support at their most recent low of 1195 last month and appear to not be wasting anytime putting a right arm on the head and shoulders pattern. The 1183 mark is a major support level. If support is violated here, the next major support level is at the 1100 area.

November WASDE yield estimates.

January soybeans did not stop to test support at their most recent low of 1195 last month and appear to not be wasting anytime putting a right arm on the head and shoulders pattern. The 1183 mark is a major support level. If support is violated here, the next major support level is at the 1100 area.