10/27/2022

Oct 27, 2022

Another day of sideways trade comes to an end. November soybeans traded 13 cents higher shortly after 8:30 this morning but were unable to hold the move higher. The weekly export sales appeared to show a solid 1.026 mln tonnes of beans sold last week but more than half of that number was previous business switched from unknown destinations. Corn sales disappointed, coming in below expectations at 264k tonnes sold. Doing a year-to-year comparison, 2022/23 corn sales are currently 47% behind and soybean sales run 5% ahead of last year at this time. The savior for the corn market has been domestic demand. Ethanol and livestock appear to be doing "okay" even with the current high price for corn and seek further ownership.

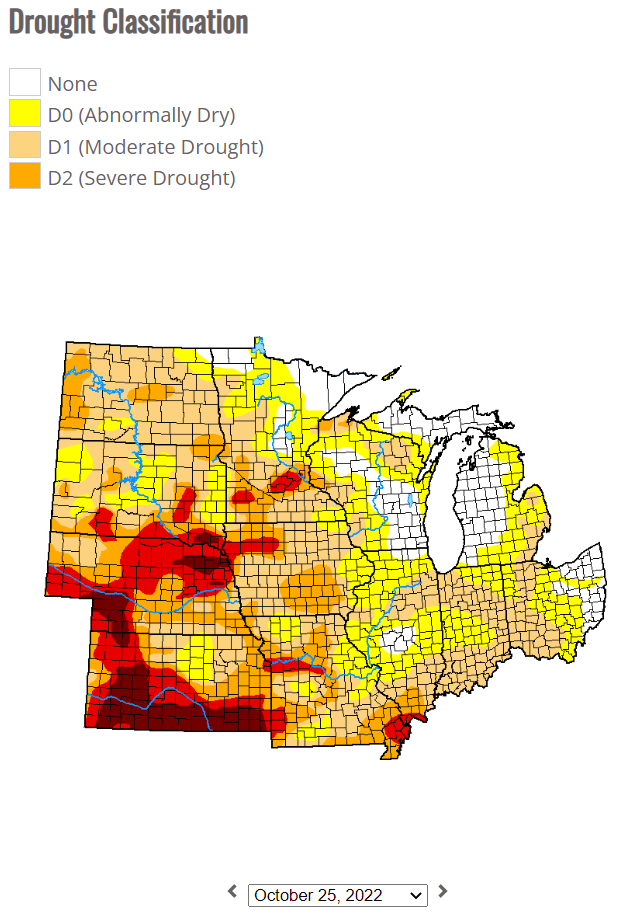

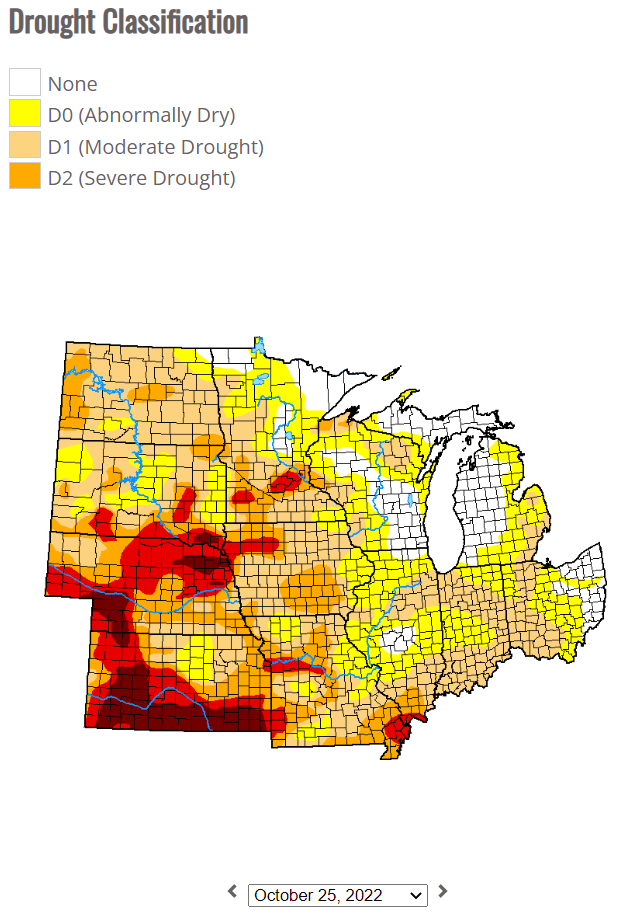

Starting to see some attention being paid to the drought monitor as harvest winds down. The current state is supportive to the market as we go into winter.

Starting to see some attention being paid to the drought monitor as harvest winds down. The current state is supportive to the market as we go into winter.