10/14/2021

Oct 14, 2021

Some early strength overnight resulted in a nice technical recovery for corn and soybeans. The 200-day moving average was the support line in corn not very long ago and was the mark for overhead resistance today, limiting gains in the front three trading months. Overall, the market became oversold very quickly after two unfriendly reports within 10 trading days of each other and a fast correction was due. This morning, the USDA confirmed the sale of 132,000 tonnes of soybeans for delivery to unknown during the 2021/22 marketing year. Ethanol numbers this week showed daily output increasing 54,000 barrels/day to 1.03 mln bpd and stocks off 84,000 barrels to 19.85 mln bbls. Comparing our fresh carryout forecasts and current market levels, grain prices are a premium when compared to the available supply. Also, following the most recent price break, US soy has become the cheapest globally. I've been struggling to quantify how inflation would affect grain prices and maybe we are finally nearing those numbers? The market appears to be comfortable with current price levels for corn in the US and soybeans may see some price improvement based on simply being the cheapest. For those in need, soybean meal futures look attractive right now. 310.0-320.0/ton is what you would typically see with $9.00 soybeans.

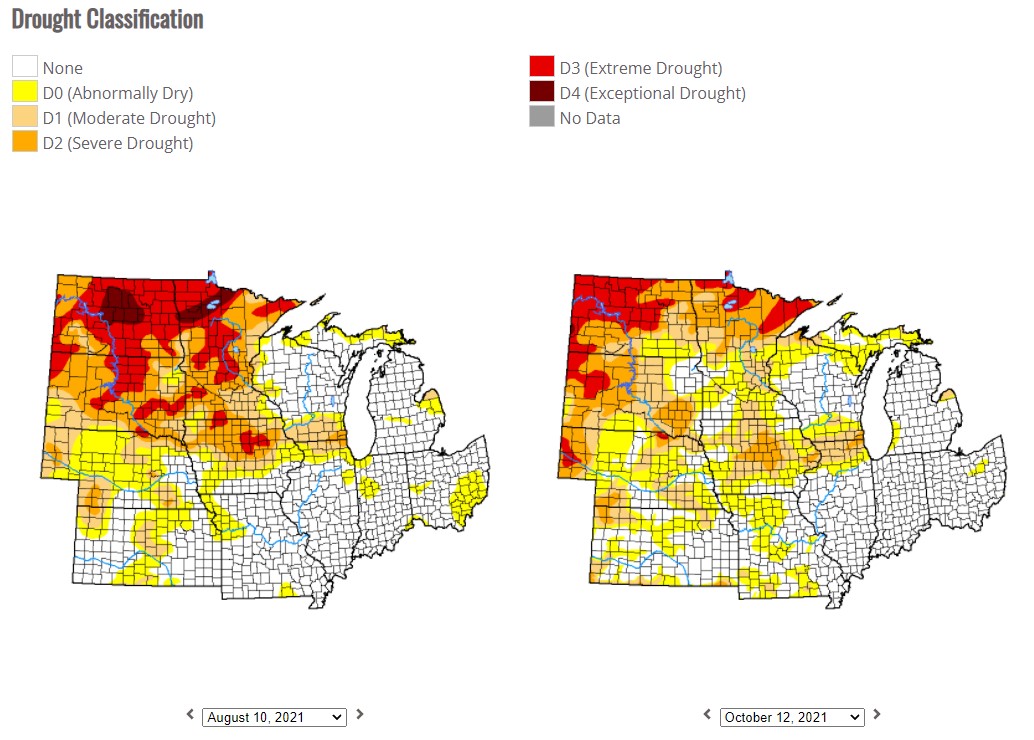

Below:

2 month change in the drought monitor.

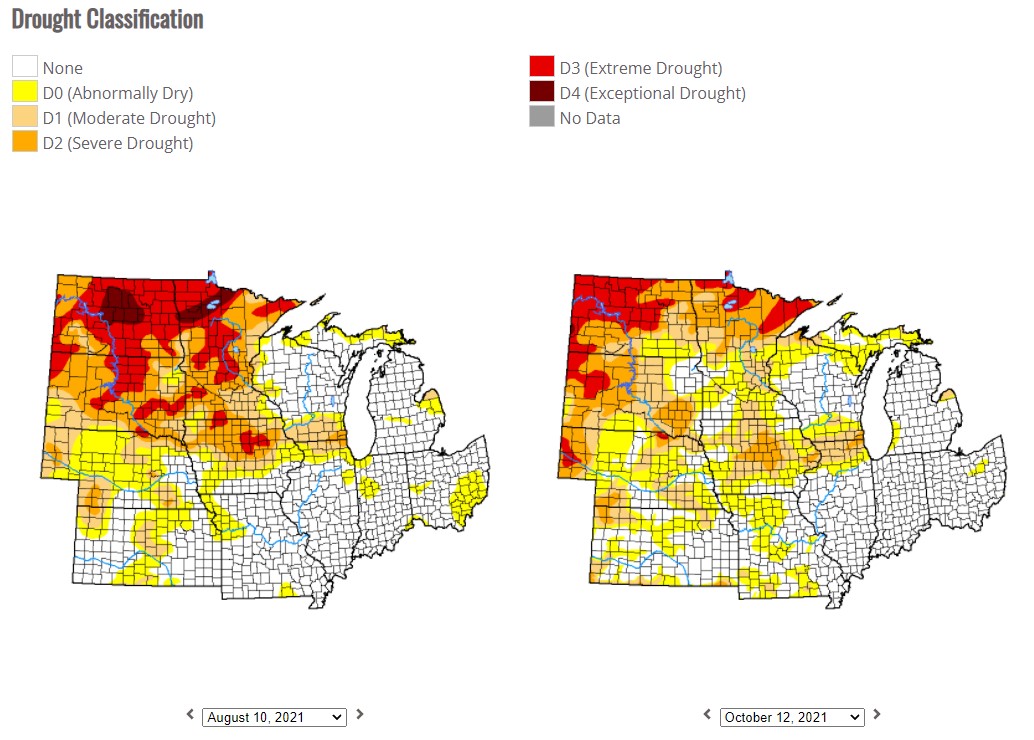

Below:

2 month change in the drought monitor.