10/12/2022

Oct 12, 2022

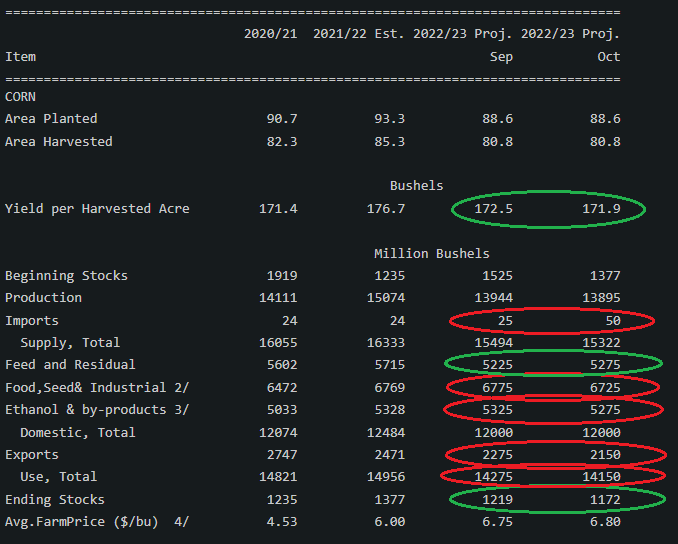

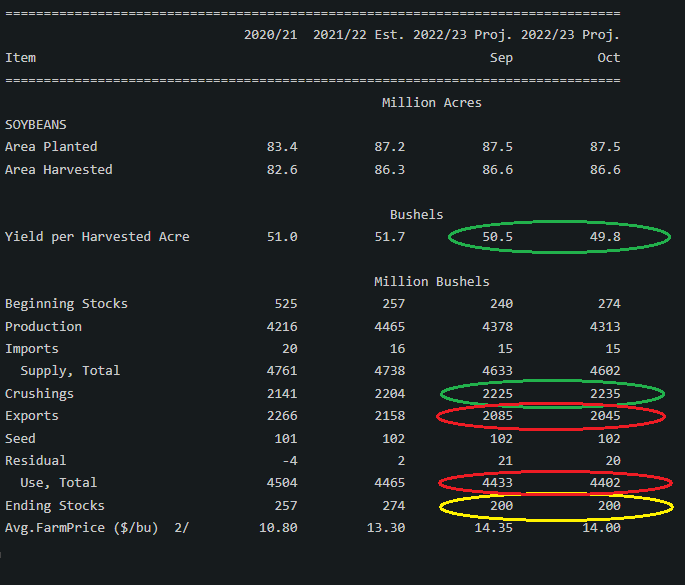

The October WASDE gave the market mostly what it was expecting. The USDA lowered corn yield to 171.9 and made a sizeable cut to this year's soybean yield, pinning it at 49.8 bu/ac. Those are drops of 0.6 and 0.7 bu/ac from the September report. A lot of numbers were moved around on the corn balance sheet this month. Along with the decrease in production, the USDA also lowered total use by 125 million bushels. December corn traded its high and low marks for the day within 5 minutes of the report release before settling back at unchanged. This make three consecutive reports from the USDA that have been friendly for corn and the market has failed to hold $7.00 or higher on the board. The report was less eventful for soybeans. The lower production estimate was met with a sizeable reduction in exports and we ended up with an unchanged ending stocks number of 200 million bushels. Initial reaction to the report saw soybeans trade 38 cents higher on the November contract to 1414'0 before settling at 1396'0.