10/12/2021

Oct 12, 2021

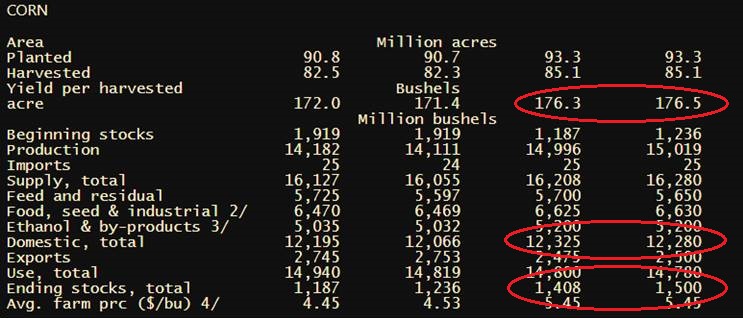

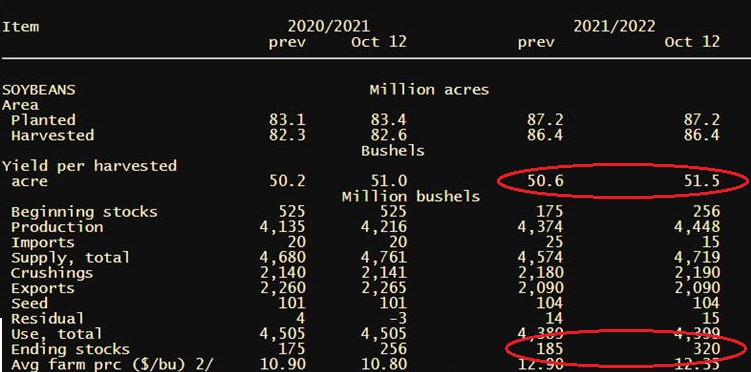

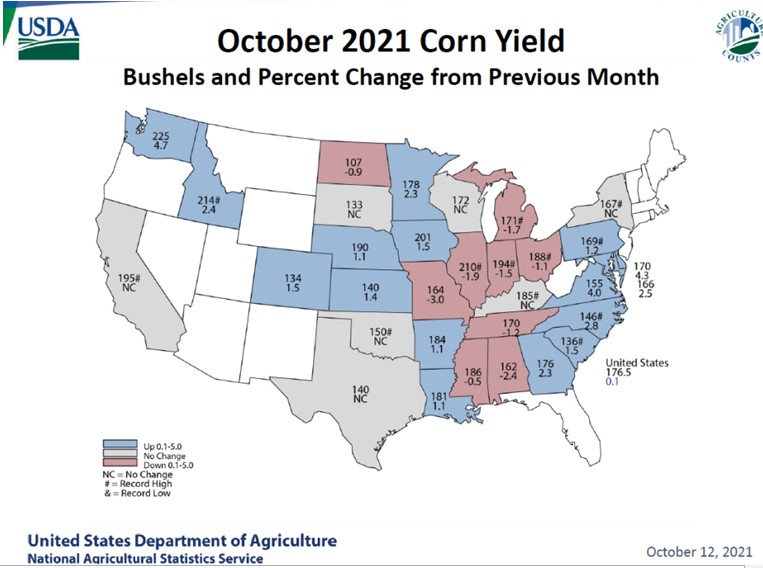

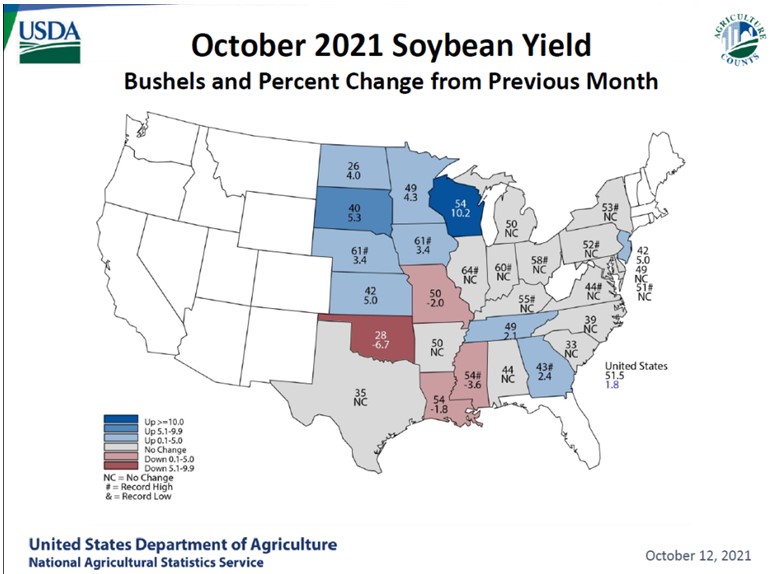

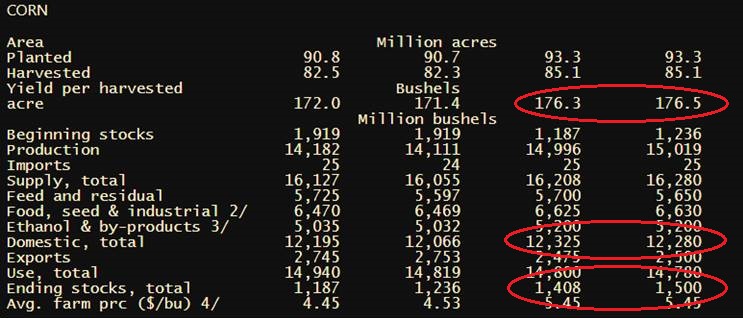

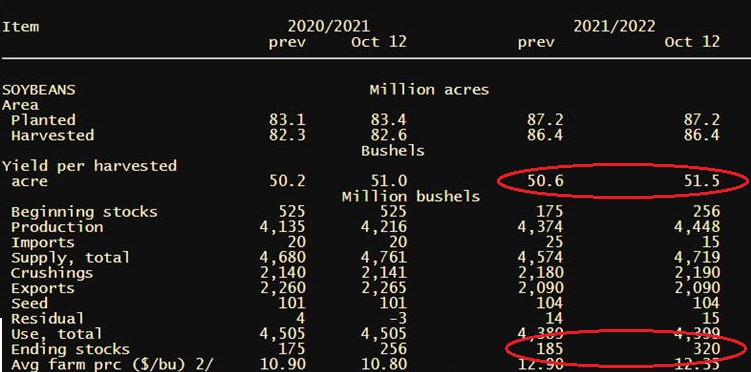

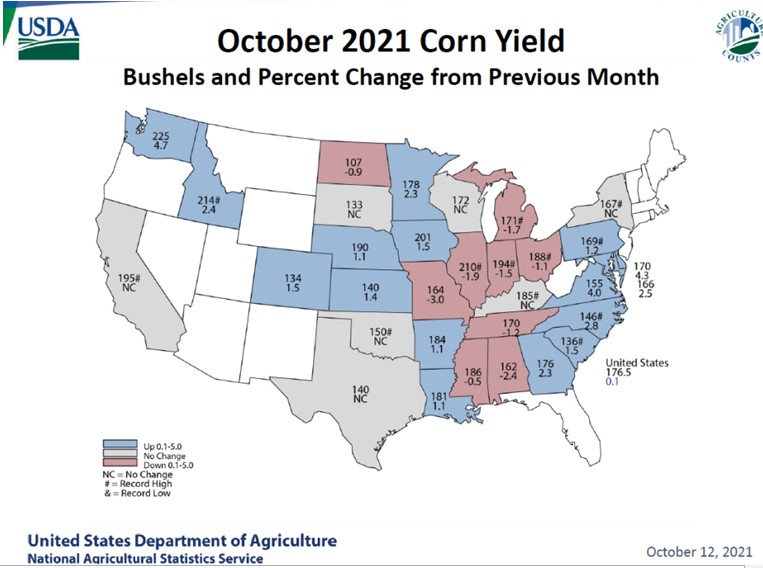

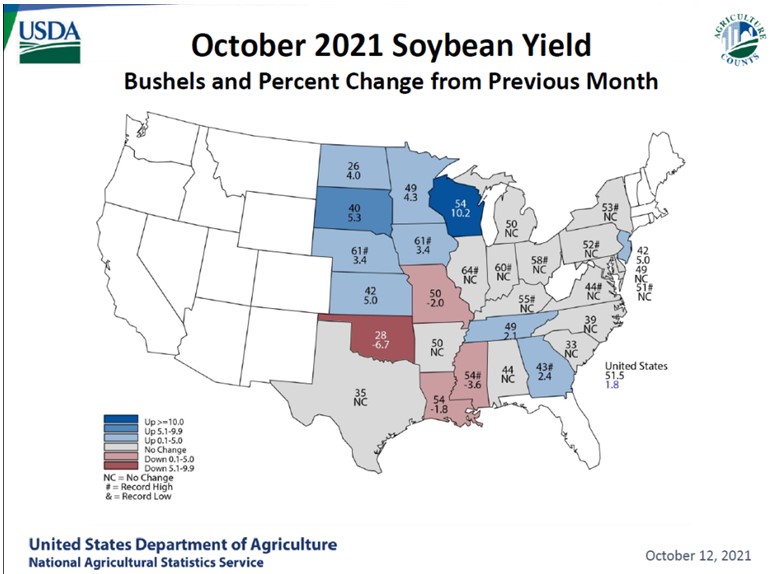

Narrow ranges defined overnight trade ahead of today's WASDE report. The USDA made an 8am announcement of 165,000 tonnes of corn for delivery to Mexico during the 2021/22 marketing year. It was widely anticipated that this report would be largely negative for soybeans and the crowd was correct. The USDA increased this year's soybean yield estimate almost a full bushel to 51.5 vs the September report number of 50.6. With the USDA increasing the size of the 2020 soybean crop by 80 million bushels in the quarterly grain stocks report and the increase in this year's estimated soybean yield, our 2021/22 soybean carryout ballooned from 185 to 320 million bushels. That's a 73% increase in one month. Trade expected the USDA to slightly trim the corn yield from last month, down .3 bu/ac to 176.0 but the USDA actually increased their yield estimate to this year's corn crop to 176.5, which would be a top 4 all-time national average yield, if verified in January. This increase in production, along with a forecasted decline in domestic use, the 2021/2022 estimated corn carryout increased from 1.4 to 1.5 billion bushels. A much better than expected crop being harvested in the western cornbelt combined with ideal conditions to begin planting in Brazil, the last few bulls remaining in this market may be heading towards the slaughterhouse.