1/12/2023

Jan 12, 2023

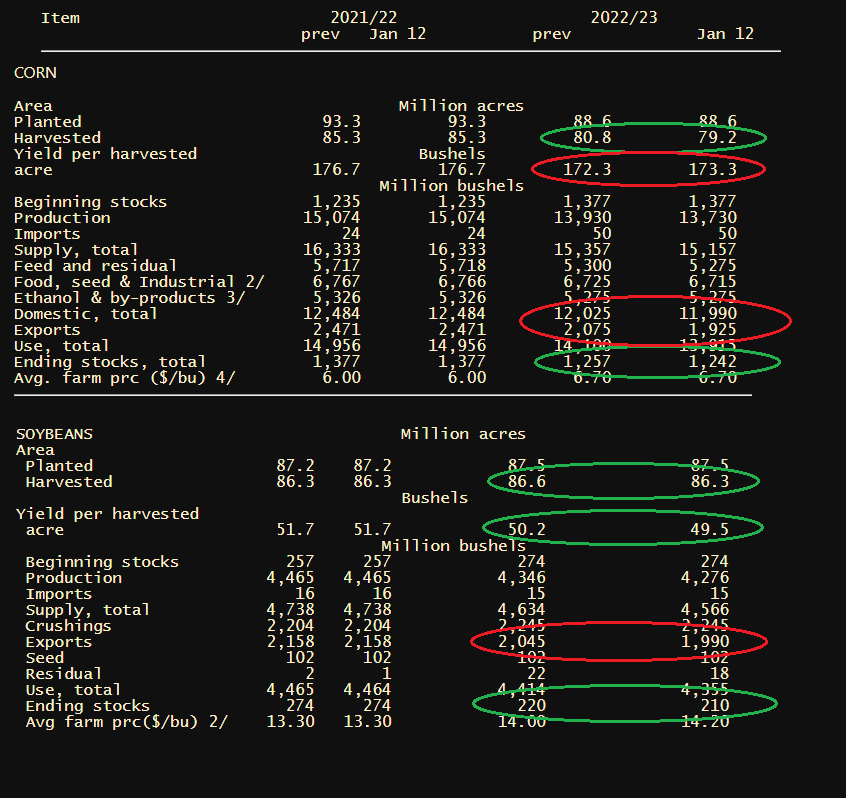

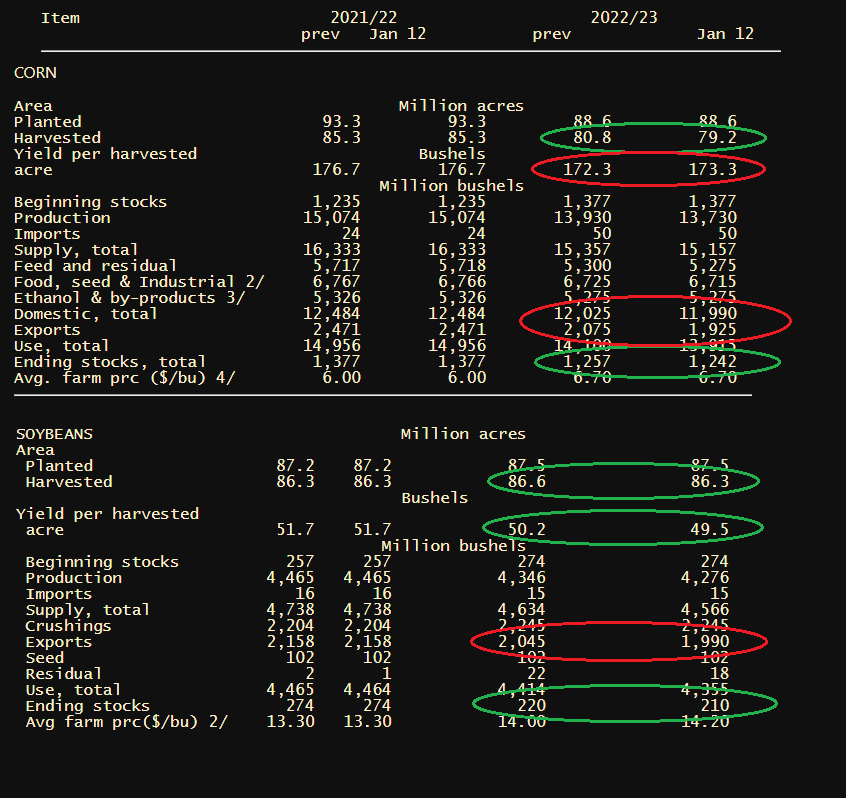

The big report dropped at 11 a.m. and brought some fireworks with it. USDA raised corn yield by one full bushel and lowered corn exports by 150 million bushels. Surprising trade was the cut to harvested corn acres, which was lowered by 1.6 million acres. The numbers trickled down the balance sheet to a small net change lower to corn ending stocks. The soybean side of the report was expected to be mostly white noise but the USDA surprised the market with cuts of 0.7 bu/ac in yield and 0.3 mln harvested acres. The weekly export sales held the market in check prior to 11 a.m. with another poor showing. Corn sales were a miss at 256k tonnes and soybeans were mid-range at 717k tonnes. Corn sales were short of the pace needed to meet the USDA's target by 342 million bushels and soybean sales matched the pace needed to meet their target using the export forecasts prior to 11 a.m.