1/12/2022

Jan 12, 2022

Today was a huge report day. Look below for a summary of the USDA's huge data dump. We did have two 8am sale announcements this morning that included 132,000 tonnes of soybeans to China for 2022/23 and 100,00 tonnes of corn to unknown for 2021/22.

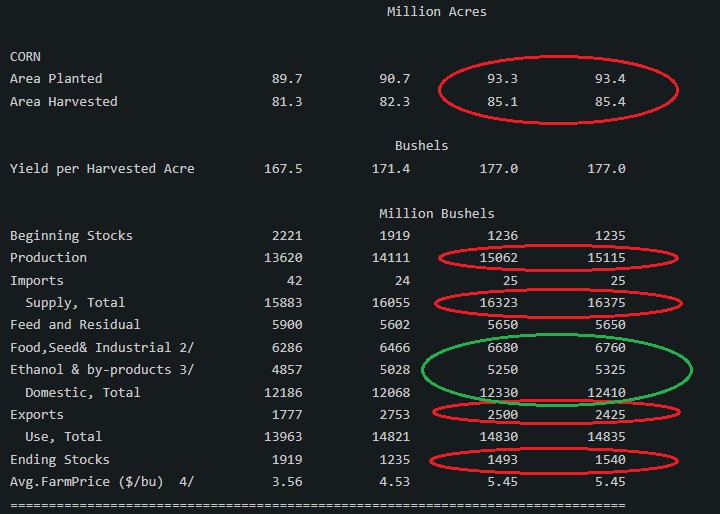

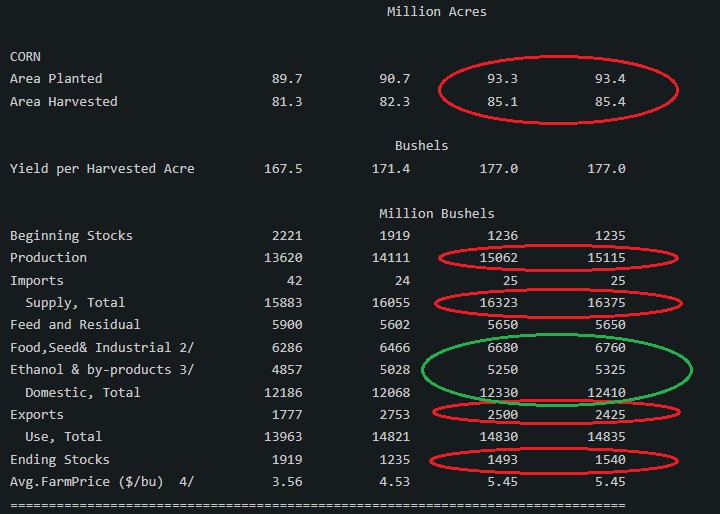

Nothing changed domestically to light a fire under the market either direction. USDA found a few more corn acres. Added ethanol use was washed out by trimming exports. Ending stocks grew.

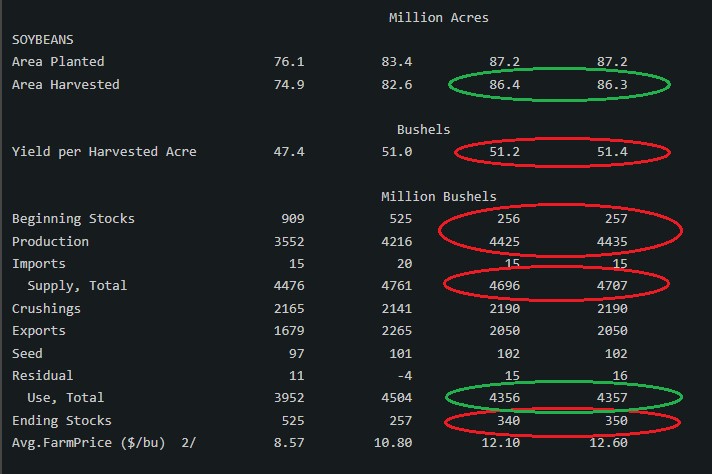

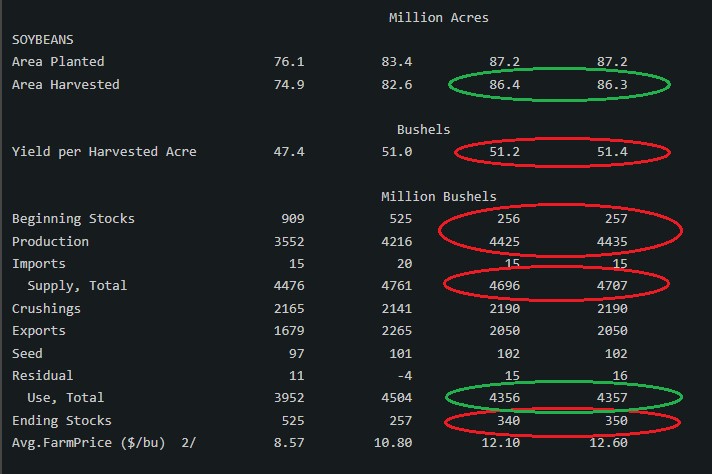

Soybean acres trimmed minimally, 51.4 average yield is second largest all-time. Domestic soy supply continues to grow. Really feels like trade is all on one side of the fence and just want to ignore anything negative.

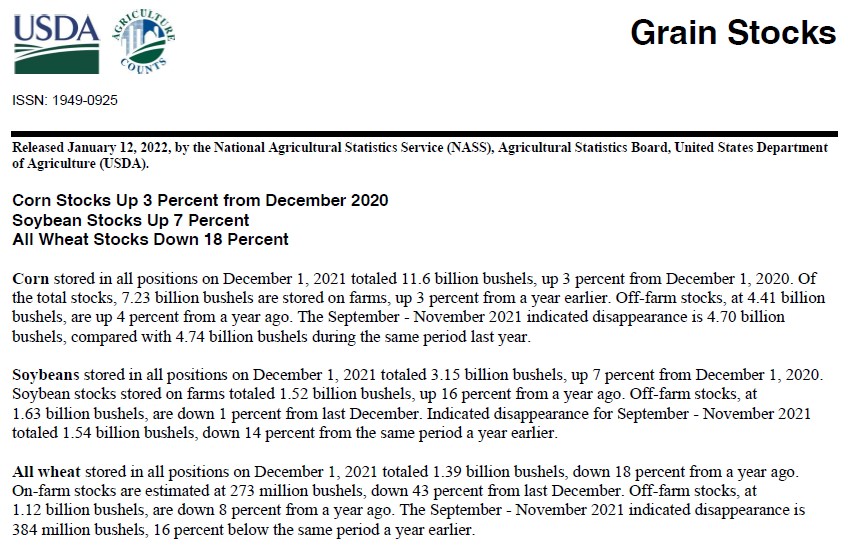

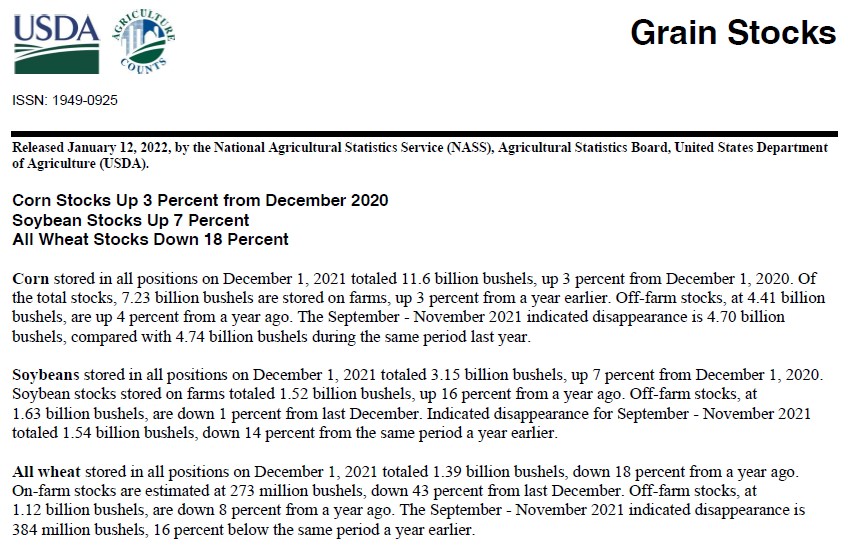

Corn and soybean stocks all increased from one year ago. Wheat stocks down sharply.

Corn and soybean stocks all increased from one year ago. Wheat stocks down sharply.

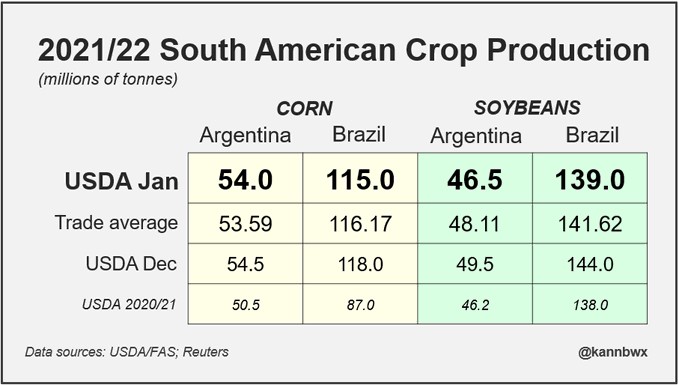

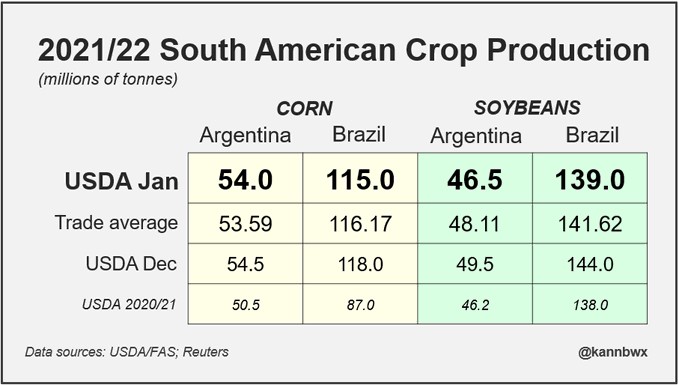

South American production is where the market found support. The USDA coming in below 140.0 for Brazil soy production was a surprise.

South American production is where the market found support. The USDA coming in below 140.0 for Brazil soy production was a surprise.

Nothing changed domestically to light a fire under the market either direction. USDA found a few more corn acres. Added ethanol use was washed out by trimming exports. Ending stocks grew.

Soybean acres trimmed minimally, 51.4 average yield is second largest all-time. Domestic soy supply continues to grow. Really feels like trade is all on one side of the fence and just want to ignore anything negative.

Corn and soybean stocks all increased from one year ago. Wheat stocks down sharply.

Corn and soybean stocks all increased from one year ago. Wheat stocks down sharply. South American production is where the market found support. The USDA coming in below 140.0 for Brazil soy production was a surprise.

South American production is where the market found support. The USDA coming in below 140.0 for Brazil soy production was a surprise.