Glacial Plains Cooperative

Energy Monthly Update - September 2021

September Monthly Update, what has the Energy department been up to?

ENERGY

You can depend on us to keep your farm or business operating smoothly, your vehicles and equipment in top condition, and your home comfortable – all while placing a solid emphasis on customer and employee safety. We also service and sell energy equipment, including storage containers and pumps.

Read on to learn more about our energy products and services, or contact a Glacial Plains energy team member with questions. We are happy to assist you in any way possible and answer any questions you may have.

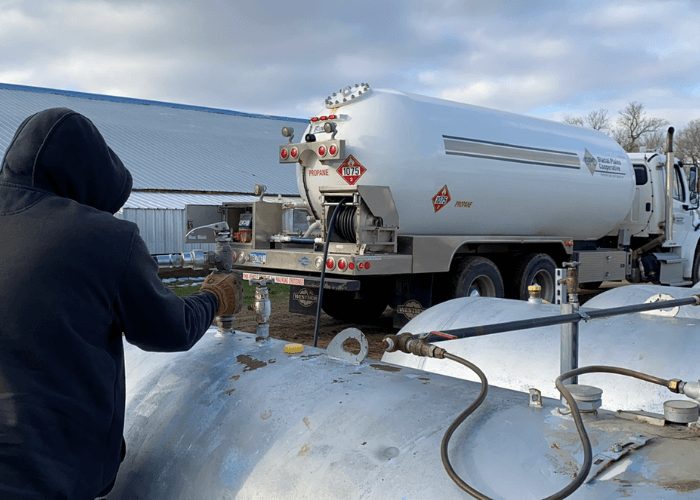

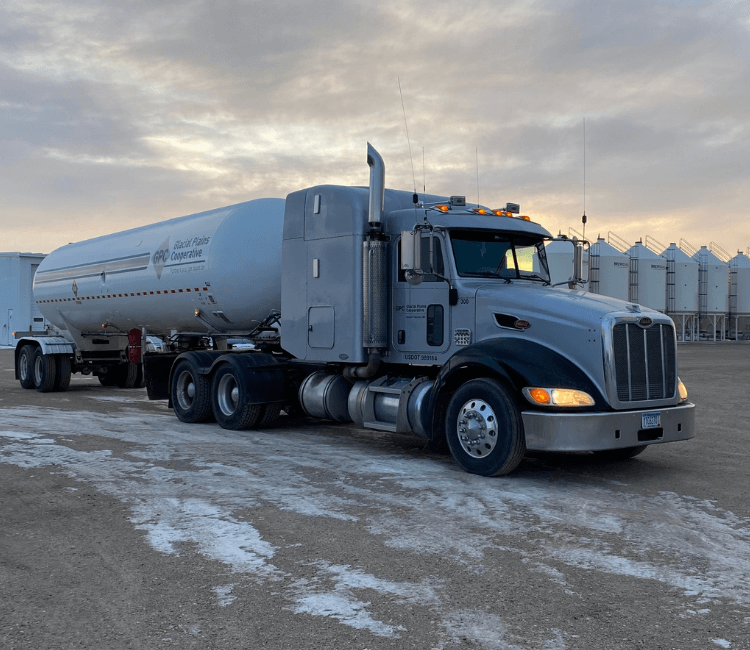

PROPANE

We also offer complete propane delivery, sales and service for our commercial and agriculture customers:

We offer the following options for our home heat contracts:

Contracting for dryer gas can be pre-paid in full or 8 cents per gallon pre-paid. We also have the ability to service those who are able to take a transport load, and we offer temporary tank sets for construction or others requiring a temporary heat source.

When proper safeguards are observed, propane provides a safe, efficient and reliable way to heat your home or business. We’re glad that you selected Glacial Plains to deliver propane to your property; your safety and well being is very important to us.

Read below for some general safety tips concerning your equipment. For any questions on the properties of propane or propane safety, you can visit www.propane101.com/ or contact an energy team member. We’re always happy to answer any questions you might have.

Through years of research and practice, the propane industry has identified three things that are critical to keeping you safe:

Our drivers will contact you to schedule a time to perform regulator replacement (or any other necessary work) on your propane system. If you have a time that you would like the work performed, please call your driver to schedule. Thank you for your business and we look forward to many more years of servicing your account.

The propane gas regulator is one of the most important parts of a propane gas system. The regulator not only acts as a control regarding the flow and distribution of propane but also as a safety barrier between the high pressure of the tank and the end use appliance(s).

Propane tank pressure can range from under 10 psig to over 200 psig. Residential applications will generally require 11 inches water column (amount of pressure required to push a column of water up 11 inches in a manometer, or about 6.3 ounces per square inch) and the regulator compensates for these pressure differences in the tank to supply a steady flow of required pressure to the household appliances. In summary, the purpose of a propane regulator is to "bottleneck" the propane down to a safe and usable pressure.

People don't realize that buying a LP gas regulator from a friend or an internet site will more than likely result in wasted money. Regardless of what one may think, regulators aren't all the same and an improper regulator or faulty LP gas regulator installation means the entire installation does not meet code and is unable to be serviced until fixed. Keep in mind that replacing the regulator means interrupting the flow of gas and a leak check is required before the gas can be turned back on. Don't put yourself in danger by attempting to buy and install your own regulator. Call your propane company or a licensed LP gas plumber. It will be safer and cheaper in the long run.

Like any part of a propane system, the regulator needs to be protected. Protecting a regulator, for the most part means keeping it covered. Regulators are generally found under the tank dome or if installed outside the dome, they will have the vent pointed down. The vent is pointed down to prevent rain, ice and debris from entering the regulator. The vent should have a screen that keeps insects out of the regulator, as some insects will make a nest in a regulator that's missing its protective vent screen.

Regulators have internal moving parts that are subject to wear and tear, so the regulator needs to be replaced after some time. Propane companies can tell consumers when the regulator needs to be replaced due to age or malfunction and the consumer needs to take this advice seriously. The industry norm is 15 years before a regulator needs replacement, while some regulator manufacturers recommend replacement every 25 years. If any regulator has ever been under water, such as on an underground propane tank, it needs to be replaced immediately. One very important fact to point out is that although propane regulators may be adjusted by licensed propane professionals, they are not repaired or subject to repair. They are replaced.

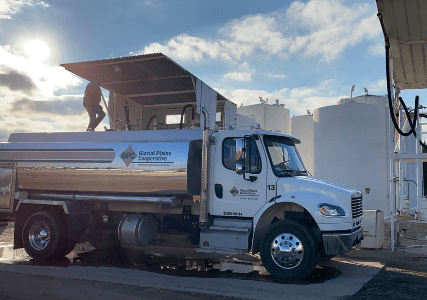

REFINED FUELS

As a licensed Cenex® distributor we carry their branded premium fuel line which includes Cenex RoadMaster XL®, Ruby FieldMaster® and WinterMaster® diesel fuels. Each of these are premium fuels that contain the seven ingredient additive package exclusive to Cenex fuels.

Learn more about additive packages here:

The Glacial Plains fuel monitoring system is very beneficial for everyone! It allows you to pay for your fuel as you use it instead of tying cash up in a delivery that you aren't going to use. Using this consumption billing also adds a layer of risk protection by billing based on price averages rather than spot prices so you don't get stuck paying full price during a price spike.

We have fuel stations located in Benson and Milan. Both of these stations carry premium Cenex® gasoline and diesel fuel, which can be purchased with your Cardtrol Card or any major credit cards 24 hours a day, 7 days a week.

| Benson C-Store 1020 Atlantic Ave. Benson, MN 56215 320-843-3999 Ext. 1 |

Milan 24-7 Fuel Station Intersection of MN Hwy 40 and US 59 Milan, MN 56262 |

LUBRICANTS

These products are available as packaged products, while a few of the more common fluids are available in bulk, as well. Looking for a grease? We can handle that, too. We can also outfit your operation with a bulk tote system. All of our Cenex® Lubricants are now located at our Benson Agronomy/Energy office. Call us at 320-843-4820 to place your order.

Not sure which lubricant is right for your application? Give us a call or visit www.cenex.com and use the equipment lookup tool under the lubricant tab.

CENEX® TOTAL PROTECTION PLAN

When you exclusively use Cenex Ruby Fieldmaster® Premium Diesel Fuels and Cenex lubricants together, you can get up to 10 years or 10,000 hours of engine and transmission coverage for a wide range of agricultural equipment.

With the variety of components being covered through your machine, it gives the peace of mind knowing you are covered. Click here to learn more about the protection plan program and register your equipment.

E-98 RACING FUEL

E-85 doesn’t necessarily have the same percentage at any given retail outlet, nor is it guaranteed to be the same from batch to batch. We have seen the ethanol percentage in E-85 range from 71% to 86%. Racers prefer a consistent formulation, which is why we’ve blended, drummed and distributed E-98 Racing Fuel since 2003.

We work with CVEC, a local ethanol plant, to provide a consistent blend of E-98 to meet your performance needs. There are still racers who get E-85 from the gas station pumps and find that the percent of alcohol changes on a regular basis. We blend our E-98 Racing Fuel so that you can dyno your motor with one of our drums and will receive the exact same product in every drum you receive from us.

Our product has been used by car manufacturers, fuel pump builders and motor builders, as well as for drag racers and modified racecar drivers.

Ethanol runs cooler than typical racing fuel, gives off less polluting emissions and is safer for those handling the product. If you’re curious about the amount of toxic products in the race fuel you currently use, just read the Material Safety Data Sheet that accompanies it.

We have wholesale and retail pricing. Please call to check for availability. Call Hank at 320-843-4820 x 1211 or (320) 760-9524 to find out how E-98 Racing Fuel can help put you in the winners circle.